As the COVID-19 pandemic continues to extend its grip on the globe — infecting more than

This is forcing executives to make big, lasting decisions with few guideposts to aid them.

Arizent, the parent company of National Mortgage News, released a new survey this week with broad industry representation to understand how executives are dealing with the impacts of the COVID-19 crisis now that they have been operating in a “new normal” environment for the last two months. This research is a follow-on to an earlier survey conducted in late March as businesses were first going into remote work environments due to the national emergency.

The April survey found that there was a surprisingly smooth, albeit hurried transition to remote work and digital customer access channels, with most companies feeling that they performed on par or above their own expectations.

However, technology issues did arise. A mortgage company respondent noted an increase in attempted hacks. That aligns with a report from risk-management vendor Dytrix, which found attempts to divert and steal funds wired during the closing process rose an estimated 65%

Companies also learned the importance of digital technology for both customers and employees. The sudden rush to remote work exposed some of those gaps and will force companies to re-evaluate their future digital investments.

While capabilities to perform

“Appraisals, closings became complicated/delayed due to company shutdowns and clients being apprehensive in letting appraiser into their home or going to a title company (if they are even open) to close loans,” one respondent wrote.

A few of the professionals surveyed noted how hot the market for refinancing has become. For some it was, in fact, too hot.

“Most of my clients who were seeking refinances have been unable to get acceptable terms due to interest rates being higher than they normally would be while the Fed continues to try to get volatility under control and liquidity back into the sector,” one said. “Lenders are artificially raising rates to slow volume and to try to make up profit margin to offset the losses they incurred in March due to margin calls on their hedges and increased costs against their warehouse lines when they could not price and sell loans into the market.”

The refinancing boom is expected to continue. This week, Fannie Mae forecasted 2020 will likely see

The pandemic has also highlighted the importance of having a strong digital presence across all retail sectors including financial services, wealth management and professional services.

“Prior to this we paid little attention to our online presence. That must change now,” said an executive at a wealth management firm.

Arizent, which also publishes American Banker, The Bond Buyer and other titles, conducted a Wave 2 survey of 592 executives on April 14-23, 2020 across an array of sectors including financial services, wealth management and professional services to understand how businesses are dealing with the crisis, their sentiments about the future and potential actions under consideration. Roughly half (48%) of survey respondents were C-level executives, more than one-third (36%) were middle and senior management and the remainder (16%) represented staff positions.

The Wave 1 survey was conducted with 304 executives on March 19-20, 2020 across a similar array of sectors. The composition of respondents was very similar to the Wave 2 survey with C-level executives accounting for 49% of respondents, middle and senior management making up 38% and staff being the remaining 13%.

The April survey addresses how executives are making changes to deal with the three biggest potential unknowns facing their companies: The economy, the ability to return to offices, and the new role of technology.

Since the national emergency was declared in mid-March, the U.S. economy has shed more than

News of potential vaccines becoming available only in 2021 and the coronavirus remaining active through May call into question when companies will be able to return to office buildings. bank branches and factories. Also, it's unclear when people will be able to resume old habits such as riding in completely full airplanes and elevators, or just simply sitting elbow-to-elbow around a conference room table.

Key findings

Three areas stood out from the survey as executives adjusted their organizations to address the pandemic: the impact of the crisis on companies, staffing levels and future plans.

Many companies have been afflicted by a multitude of problems including revenue loss, employee emotional turmoil and customers unable to access accounts through digital channels.

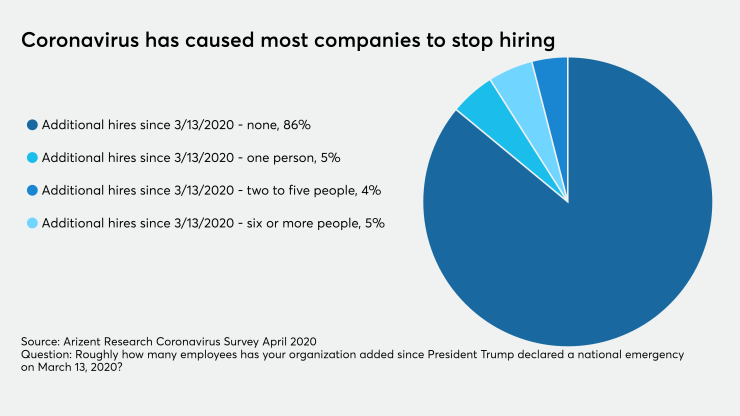

About 86% of all companies have added no new employees since the U.S. declared a national emergency on March 13, and 25% of executives surveyed reported that they had layoffs of one or more people since that declaration. As the pandemic drags on, executives are beginning to explore further staffing issues and priorities such as salary cuts and retention of key talent.

As with the impact of the pandemic, future plans also varied greatly from digital investments to when companies expect to return to offices.

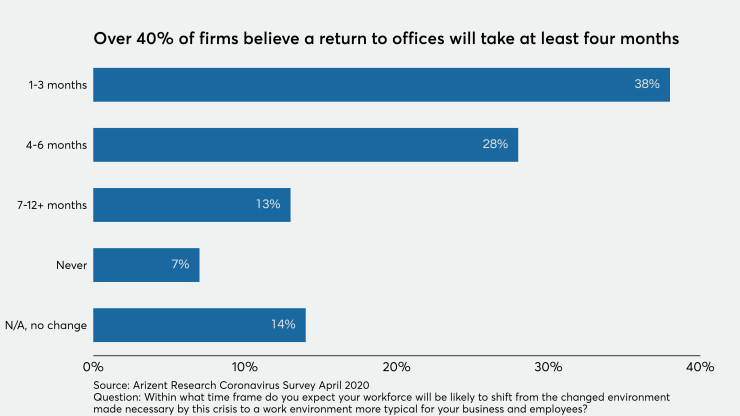

About four-in-ten (38%) of all companies surveyed expect to return to their offices in one to three months, with financial services firms coming in at 41%. However, 30% of financial services executives stated that it would more likely be four to six months before they could go back to their offices, and another 11% said that they would never be able to return to the old approach as the pandemic had irrevocably changed their approaches to work.

Working from home isn't everything

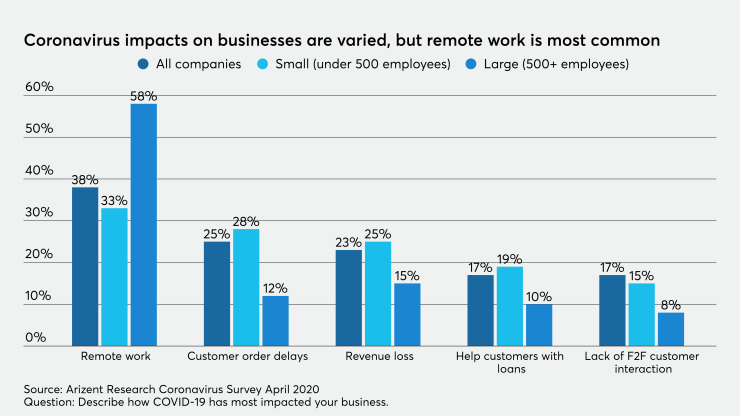

Being forced into a remote, distributed work environment was the single largest impact of the pandemic affecting 38% of all companies and over half (58%) of large companies.

Since large organizations are more likely to work in office buildings, it should come as no surprise that many have been forced to work remotely. For example, Discover shifted almost its entire 8,000 personnel call center operations to a work-from-home environment within days of the national emergency being declared. Prior to this change, Discover’s call centers had operated from four office buildings spread across the U.S. Overall, 45% of financial services executives reported that their companies have had to shift to a remote work environment.

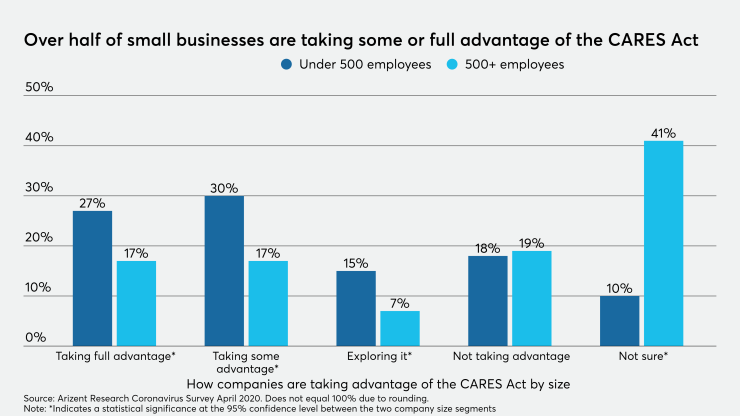

It should be noted that the definition of small organizations being used in this survey is in alignment with the CARES Act Paycheck Protection Program, which declares all organizations at fewer than 500 employees as being eligible for government assistance.

Despite the attention to remote work environments — ranging from media attention to Saturday Night Live skits — the fact that over half of all companies are not working remotely speaks to the inflexibility of many companies' business models.

For example, many bank branches now operate via drive-thru window service, credit card imprinters operate factories using minimum staffing levels and social distancing, and auto lenders are using contactless drop-off and delivery of financial documents where electronic signatures are not available.

Credit unions and banks that did not have robust digital account opening processes are struggling to add new customers, short of making them visit branches.

Cash flow is the second largest area of impact, as it encompasses customer order delays and revenue losses. One-quarter (25%) of executives reported that they have had to delay completing customer orders, with the effects felt slightly higher in professional services (31%) and slightly lower in financial services (20%).

About 25% of executives reported revenue loss as a major impact of the pandemic on their organizations. The immediate consumer pullback on spending following the emergency declaration, coupled with rising job losses could make this impact grow as time progresses. Additionally, as companies delay expansion plans, hiring and other investments, revenue impacts could be felt for months to come.

Most companies were pleased with their responses to the crisis

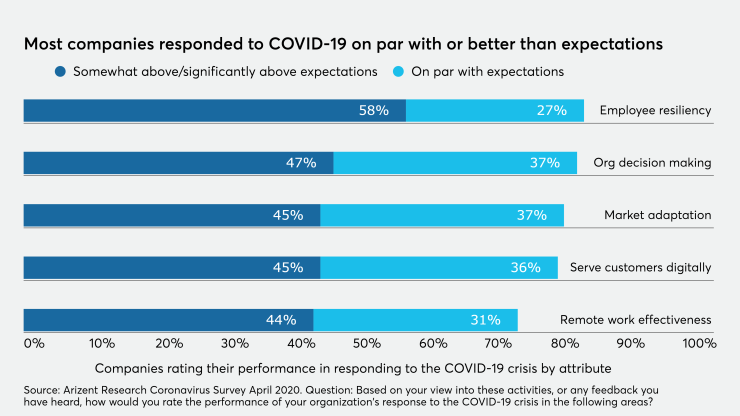

Overall survey respondents rated their organizations’ performance in response to the pandemic positively on almost all attributes including employee resiliency, organizational decision-making, adapting to new market conditions, serving customers digitally and remote work effectiveness.

Roughly 85% of executives rated their companies’ performance in response to COVID-19, as it relates to employee resiliency, as performing on par with or exceeding expectations. Over half (58%) rated their performance somewhat above or significantly above expectations, and more than one quarter (27%) rated their companies as meeting expectations.

Executives reported that their companies rated almost as highly in meeting or exceeding expectations on other metrics such as organizational decision making (84% combined), adapting to new market conditions (82%) and serving customers digitally (81%).

Only when it came to remote work effectiveness did one-quarter (12%) fall below expectations, which could potentially be as a result of the almost immediate transition to a work from home environment with little forewarning. Despite this, at least 44% of companies exceeded expectations and 31% met overall expectations in response to the national emergency being declared.

C-suite executives are most concerned about long-term organizational survival

Companies face a unique set of market conditions that challenge how they conduct business, fundamental changes in consumer demand, and the impact on remote employees who may also be providing in-home schooling or day care. However, it’s clear that C-suite executives are most concerned about long-term issues facing their organizations.

About four-in-ten C-suite executives were most concerned about the future financial liquidity (41%) of their businesses and customer attrition (39%). Companies with large physical footprints — such as banks with branch networks, card issuers with call centers, organizations that still rely on manual approval processes, as well as those holding loans — are keen to recognize the drain on resources and the potential for defaults. Similarly, in the new fashion of consumers being forced to interact with companies through digital channels, there is also a potential that a digital challenger may come in to steal market share.

C-suite executives also worried about workforce stability (30%) and advancing new initiatives (25%). Despite employee resiliency being high two months into the crisis, executives are recognizing that there is an additional strain being placed on workforces, particularly individuals who may be handling schooling and day care during the pandemic.

Executives took swift action

Since the U.S. declared a national emergency on March 13, roughly 86% of executives surveyed reported that their organizations have not hired one additional person. An additional 9% said that they had hired between one and five new staff.

Accounting firms were most impacted, with 96% reporting no new hires. Less affected groups included financial services (72% no new hires) and fintech firms (70% no new hires). Companies with under 500 employees reported a higher hiring freeze rate at 88%, compared to large smaller companies at 70%.

Companies were quick to reduce their headcount after March 13, with 25% of executives reporting that their organizations had subtracted one or more staff. About 29% of large companies (500+ staff) had made a reduction, while only 25% of small companies (under 500 staff) had made a workforce reduction.

Over half (57%) of small organizations with fewer than 500 employees were taking advantage of some or all aspects of the CARES Act aid package, while only one-third (34%) of larger organizations with more than 500 employees were taking advantage of the CARES Act.

Financial institutions were prepared, but are still planning ahead

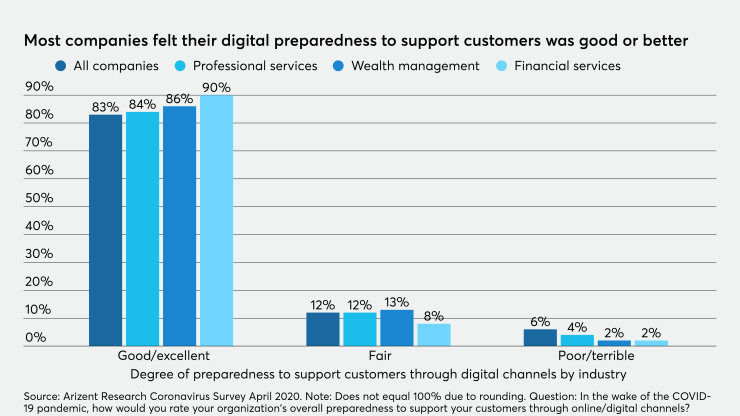

Most executives rated their companies’ degree of preparedness to support customers through digital as good or excellent (83% overall). Financial services executives gave their businesses a 90% rating, which was the highest, and another 8% reported their preparedness as fair.

The growing digital nature of online banking and similar services played a major role in creating a strong degree of preparedness. In being pushed by challenger banks, online tax providers, digital mortgage companies and robo-advisors, entire industries have been forced to create digital channels as alternatives to their branches.

This competitive pressure, coupled with companies adapting to demands from tech-savvy consumers such as millennials and Gen Z, has prepared these institutions to survive and in some cases thrive in a mostly digital world.

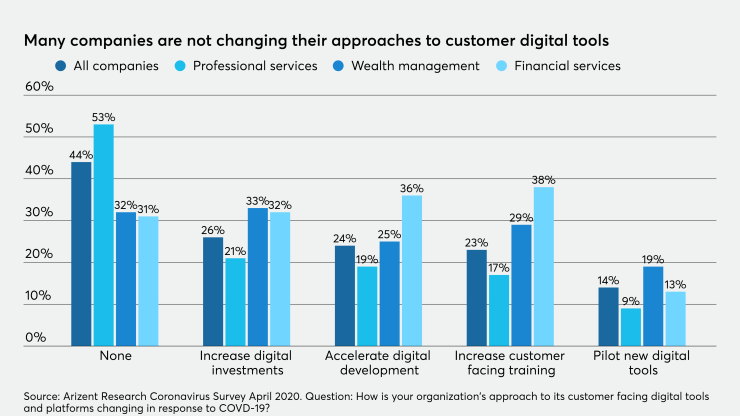

When asked about changes to digital strategies, a fair number of companies (44% overall) reported that they would not change their approach. Less than one-third of financial services firms (31%) and wealth managers (32%) said they would stay the course, while 53% of professional services firms said that they would maintain their digital approach.

About one-third of financial services firms said that they would increase their digital investments (32%) and accelerate digital development (36%). One area of note is that 38% of financial services firms said that they would increase training for staff members to help customers access their digital channels.

“Customers access to — and unfamiliarity with — digital technology remains a hurdle for some,” said one banking executive.

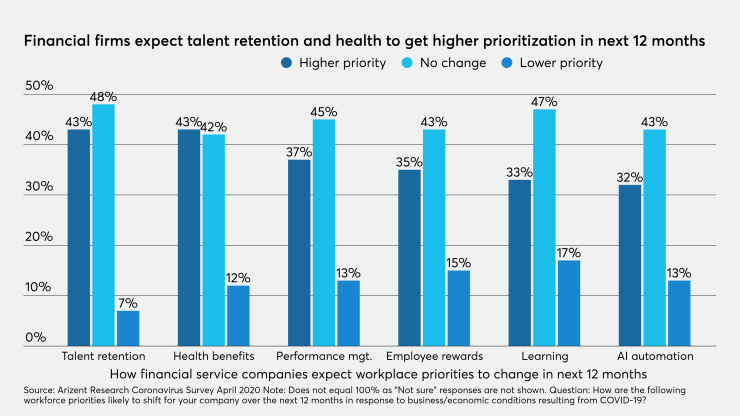

Talent retention, health benefits are higher priorities

Looking ahead over the next 12 months, financial service executives reported that two areas would become higher workplace priorities: talent retention and improved health benefits, which were both tied at 43%. This is most likely due to the increased strain on workforces operating in remote environments, with limited access to schools and hospital care.

Staff costs under consideration for future action

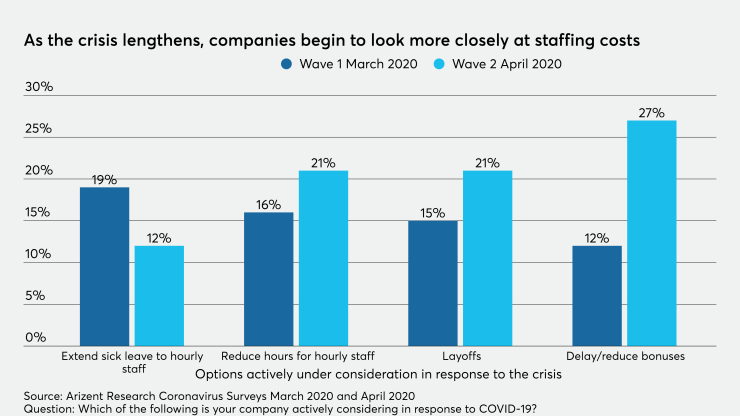

While 28% of all companies reported that they were considering a hiring freeze, the grim reality is that — even without an official hiring freeze in place — 86% of companies have not hired a new staff member since the declaration of a national emergency on March 13. Additionally, 25% have reduced their workforces by one or more people since the announcement.

Since the Wave 1 survey conducted in late March, executives' willingness to delay or reduce staff bonuses has shown the highest increase, going from 12% to 27% in the Wave 2 survey conducted in late April. One-in-five (21%) executives reported considering layoffs and/or reduction in hours for hourly staff.

Extending sick leave to hourly workers has fallen in consideration between the two waves, from 19% to 12%, however this may be due in part to recent government legislation (

It may take four months to a year to come back

There is no general consensus among executives on when they expect to return to office buildings and branches to operate in a similar work style as they had before the COVID-19 crisis.

Over one-third (38%) of executives expect to return to some semblance of their old office environment in one to three months, while over one-quarter (28%) expect to return in four to six months.

Seven percent of all executives said things will never return to normal while 11% of financial services executives echoed that sentiment.

Conclusion

Digital channels, which were once considered supplemental to face-to-face interaction in branches and other settings, are now the primary means companies have to interact with their customers — and their employees.

And things won't return to normal any time soon. A lot of these changes will be permanent.

The complete cut-off between staff and customers marks a tipping point where digital has become the new main channel. Future ROI investment calculations for digital investments need to consider if a company can survive if it continues to rely on physical interactions to complete a transaction, such as a written signature, where its competitors do not have this reliance or weakness.

Companies will need to proactively engage all customers regardless of age, affluence or digital capability on an equal level in order to maintain a healthy portfolio of clients. The luxury of creating mobile apps and other tools that benefit only a small segment leaves an organization at a higher level of customer attrition risk.

In just the month since the Wave 1 survey, executives changed their perspectives on a number of issues, such as whether to reduce staff levels, bonuses or hours. As the long-term effects of the crisis grow, executives may see such moves as inevitable.

This "new normal" will require companies to invest in staff training to teach their clients how to use digital tools. It will also require companies to invest in technologies that may appear to be simple, yet will require a high degree of sophistication. For example, using a virtual assistant such as Amazon's Alexa to conduct voice banking and money transfers may appear to be a simple process, yet it will require a higher degree of authentication than many use today.

The return to office buildings, credit card call centers, mortgage processing units and bank branches will occur at some point in the future, however when and in what capacity is still unknown.

Companies need to recognize that the old way of working may not return this year (if at all), given the high transmission rate of the coronavirus. Additionally, a second or third wave of the coronavirus pandemic is a strong possibility, as happened during the 1918-1919 Influenza Pandemic.

Beyond the current coronavirus crisis, business continuity plans need to take into consideration other potential pandemics or natural disasters that could force them to abandon face-to-face interaction for extended periods of time. Companies will need to adapt how they manage their workforces to address issues child care, mental health and other considerations that have been largely left to the employee to manage.