Homepoint is adding a jumbo adjustable-rate mortgage product to its wholesale menu as demand for these loans increases amid higher interest rates and home prices.

These loans are available in amounts up to $2.5 million, with a maximum loan-to-value ratio of 80% based on the borrower's credit score, amount and purpose. It is a qualified mortgage product, with a minimum credit score of 700.

It has seven- or 10-year fixed rate periods and afterwards the loan adjusts every six months. They are indexed to the 30-day average

Homepoint first rolled out SOFR-indexed adjustable-rate mortgages last November for conventional and agency high-balance borrowers. It had discontinued Libor ARMs at the beginning of the pandemic because of low demand and the pending elimination of that index.

"Homebuyers today have

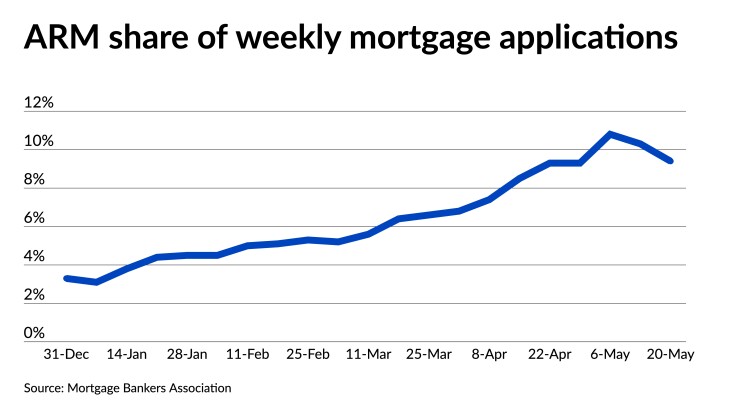

This was down from 10.3%

And for

These new jumbos are available for first or second homes, and can be used for purchase, cash-out refinancing and rate-and-term refis.

The initial adjustment limit is 5%, with subsequent 1% and lifetime 5% caps.