Another rise in borrower purchasing power helped offset the historic lack of housing supply caused by “homebodies” who are holding onto their properties rather than listing them, according to First American.

Actual home sales outpaced the company’s Potential Home Sales Model by 4.3% in May, the equivalent of about 272,588 units. The model had predicted a

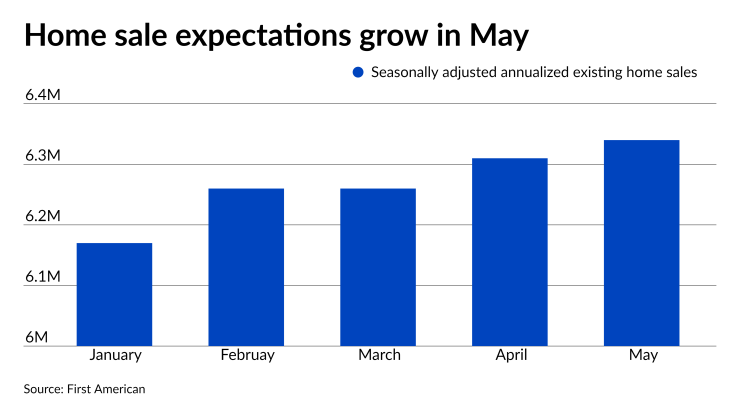

The sales increase drove the seasonally adjusted annualized rate of existing home sales to 6.34 million from April’s 6.31 million. Gains in household income and

However, homeowner tenure rates are hitting new record highs and hampered potential May sales by 17,000, according to First American Chief Economist Mark Fleming. Average tenure length rose 0.4% monthly — the largest monthly gain since August 2020 — and 4% annually in May to 10.6 years. For reference, before the housing market crashed in 2007, the average length a borrower stayed in a home sat at around five years and it was approximately eight years between 2008 and 2016.

“Two trends are locking homebodies in place and

As long as existing home inventory remains constrained, the median home price will continue soaring,

“This is the third month in a row prices were at least 25% higher than they were in 2019, the most recent ‘normal’ year,” Holden Lewis, home and mortgage expert at NerdWallet, said in a statement. “This trend can't go on forever. Otherwise, the only first-time home buyers will be millionaires."