While affordability continues to affect homebuyers, rising income combined with descending interest rates and decelerating housing values boosted the purchase market, according to First American Financial Corp.

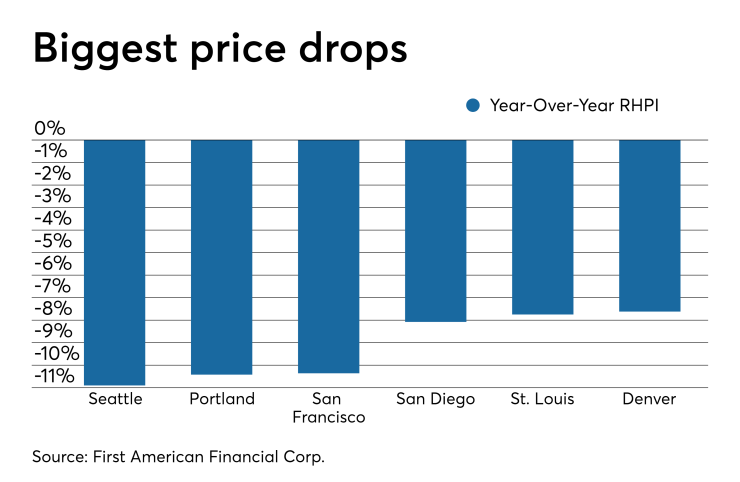

Nationally, "real" house prices fell 4.6% annually and 2.2% month-over-month in June, according to a First American analysis of home values, factoring in local wages and mortgage rates in large cities.

"When household income rises, consumer house-buying power increases," Mark Fleming, chief economist at First American, said in a press release. "

Seattle

"Consumer house-buying increased by $44,000 (12.2%) in June compared with one year ago, more than enough to overcome the 7% increase of nominal house price appreciation," said Fleming. "In fact, house-buying power is the highest it’s been since we began tracking it in 1991."

The data, from the First American Real House Price Index, measures annual home price changes, taking local wages and mortgage rates into account "to better reflect consumers' purchasing power and capture the true cost of housing."

The Federal Housing Finance Agency saw similar results in its second-quarter House Price Index,

"House prices rose again in all states and the top 100 metro areas, but the pace of growth has slackened," William Doerner, supervisory economist at FHFA, said in a press release. "The majority of states and cities are experiencing slower house price gains than they did a year ago, even with constrained housing supply and extremely attractive mortgage rates."