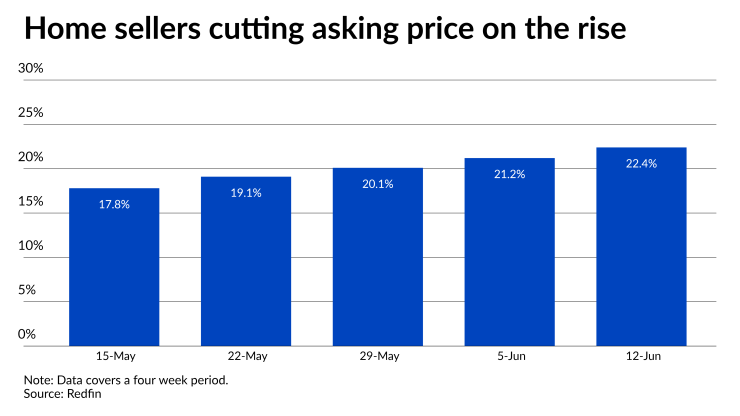

The share of listed homes that had a cut in asking price reached an all-time high during the four weeks ended June 12, as competition among buyers hit a 15-month low during May, Redfin said.

Redfin's seasonally adjusted Homebuyer Demand Index fell by 14% compared with the previous year, declining for

But those trends are not keeping sellers from reaching for the moon and getting it: the median asking price of newly listed homes increased 16% year-over-year to $409,251, while the median home sale price was up 14% to a record $399,806 for the June 12 period.

"The housing market isn't crashing, but it is experiencing a hangover as it comes down from an unsustainable high," said Redfin Deputy Chief Economist Taylor Marr in a press release.

The per-week average of 5.6% of homes having a price drop set a record since Redfin started collecting this data at the beginning of 2015. In total, 22.4% of sellers during the entire four-week period cut their asking price.

"This week's rate hikes will further stretch homebuyers' budgets to the point that many more may be priced out," Marr said. "While a lot of home sellers are already dropping their prices, more homeowners will likely decide to stay put now that the mortgage rate on a new home is significantly higher than their current one."

The monthly mortgage payment on the median asking price home increased to $2,514 at the

All of this is taking a toll on competition in the market.

In May, 57.8% of home offers written by Redfin agents were up against at least one other bidder, the lowest level since February 2021 (on a seasonally adjusted basis), and the fourth consecutive monthly decline, a separate report said.

That was down from a revised rate of 60.9% for April and a pandemic peak of 68.8% during

The typical home in a bidding war received 5.3 offers in May, compared with 6.8 in April and 7.4 in May 2021.

Competition is expected to dwindle throughout the rest of 2022, with the rate of bidding wars to fall below 50% by the end of the year, Redfin's economists predicted.

Meanwhile, the start of the homebuying season is not as strong as it has been in the past. While May's home sales closings increased by 5.8% over April, these declined by 8.5% when compared with May 2021, a Remax report noted.

The change between April and May was approximately half of the average gain in May during the pre-pandemic years between 2015 and 2019.

May ended with 16.3% more homes for sale than in April, the second month in a row in which inventory grew. And it was the first month in 2022 to have a year-over-year increase, at 2.2% over May 2021.

But that only marginally moved the supply of inventory metric, to 0.9 months in May from 0.8 months for April. A year ago, the supply was at 1 month.

May's median sales price of $430,000 according to Remax' data, grew 1.2% over April's $425,000 and was 13.2% higher than $380,000 for May 2021.

"A decline in home sales isn't entirely unexpected given the higher mortgage rate environment, but the gains in inventory are welcome news for buyers who are now starting to see a few more listings come onto the market during their home search," Nick Bailey, Remax president and CEO, said in a press release. "Affordability remains a concern, but homebuyers are regaining some control which has been long overdue."