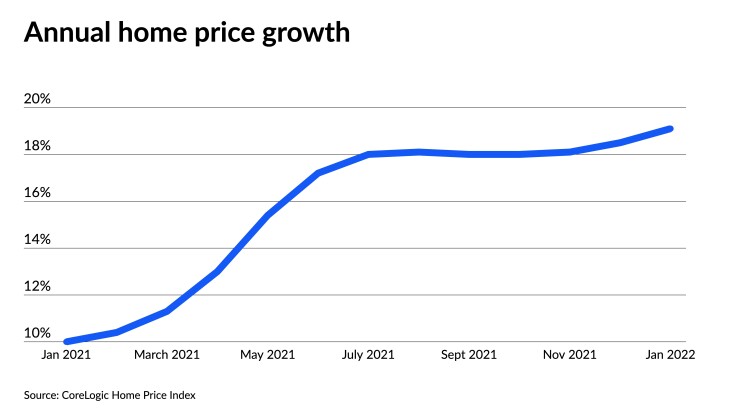

Annual home price appreciation continued unabated in January with growth accelerating at its fastest rate in decades and leading to overvaluation in some markets, according to CoreLogic.

CoreLogic’s Home Price Index increased 19.1% in January on an annual basis, the most rapid since its inception in the 1970s, after a year-over-year jump of 18.5% in December. Prices also climbed by 1.4% on a monthly basis as well.

Despite ongoing market and economic challenges, including limited inventory, buyer competition and

"In December and January, for-sale inventory continued to be the lowest we have seen in a generation. Buyers have continued to bid prices up for the limited supply on the market,” Nothaft said in a press release.

“However, the rise in mortgage rates since January further eroded buyer affordability and is expected to slow price gains in coming months,” he said.

Last week, the Mortgage Bankers Association

On a regional level,

But CoreLogic also rated some of the major metropolitan areas in those states, including greater Phoenix, Las Vegas and Miami regions, as overvalued based on market condition indicators. Phoenix prices grew by 30.2% year over year, Las Vegas homes appreciated by 25.2% while Miami saw an 18.7% increase since January 2021. The Lake Havasu City/Kingman market in Arizona was also listed as the market at greatest risk of depreciation over the next 12 months.

Markets are labeled as overvalued if the current home price indexes exceed their long-term values by greater than 10%.

The District of Columbia experienced the slowest pace of price appreciation, growing by 3.8%. Ranking ahead of the capital were Alaska at 7.4%, North Dakota at 7.8% New York at 8% and Illinois at 10%.

CoreLogic uses numbers from public record, servicing and securities real-estate databases to come up with its Home Price Index each month. Its Januarry report also mirrored

CoreLogic’s index also tracks values of detached and attached homes. For detached properties, prices increased by 20.3% annually in January, while detached units, such as townhomes and condominiums, appreciated by 15.2%.