The lack of housing affordability, caused by rising home prices and mortgage rates, remains a roadblock to homeownership.

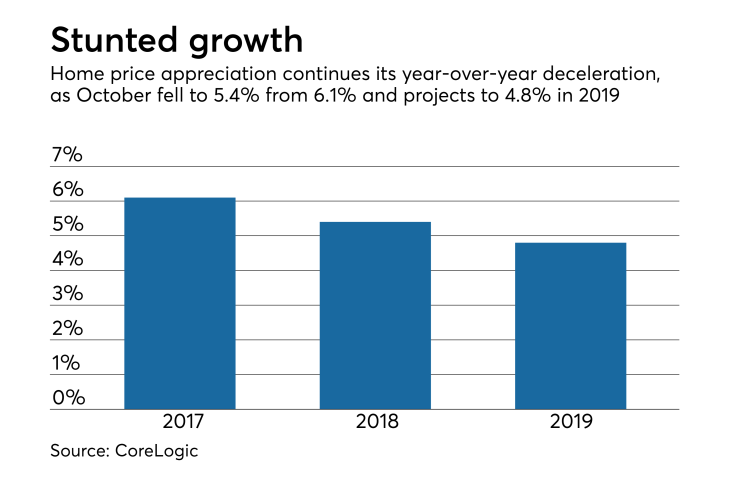

While price appreciation was up 5.4% year-over-year in October

"Rising prices and interest rates have reduced homebuyer activity and led to a gradual slowing in appreciation. October's mortgage rates were the highest in seven-and-a-half years, eroding buyer affordability," Frank Nothaft, chief economist for CoreLogic, said in a press release.

"Despite higher interest rates, many renters view a home purchase as a way to build wealth through home-equity growth, especially in areas where rents are rising quickly. These include the Phoenix, Las Vegas and Orlando metro areas, where the CoreLogic Single-Family Rent Index rose 6% or more during the last 12 months," Nothaft continued.

On a state-by-state level, Nevada had the highest year-over-year growth in home prices at 12.1%. Idaho trailed closely behind at 12% and West Virginia was the only other state in double digits at 10.1%. Of the country's 100 largest metro areas, 35 have overvalued housing markets, keeping renters from turning into buyers.

"Homeownership remains an important part of the American dream,” said Frank Martell, president and CEO of CoreLogic. "Our research found that being a homeowner makes consumers feel safe in their homes. Renters really want something to call their own. However, until affordability comes back into balance, renters will have a hard time purchasing a home."