Home prices nationwide will increase 7% through the second quarter of 2022 with no signs of the

"Buyer demand is strong in nearly every market in the country," Veros CEO Darius Bozorgi said in a press release. "We are squarely in a seller's market and buyers have no choice but to put forward the best offer they can, frequently making offers above asking price, to secure the home they want to own."

Furthermore,

"Despite that, [Federal Open Market Committee members] have not slowed the pace of bond buying," Fox added. "They have their foot on the accelerator full speed ahead and are only thinking about

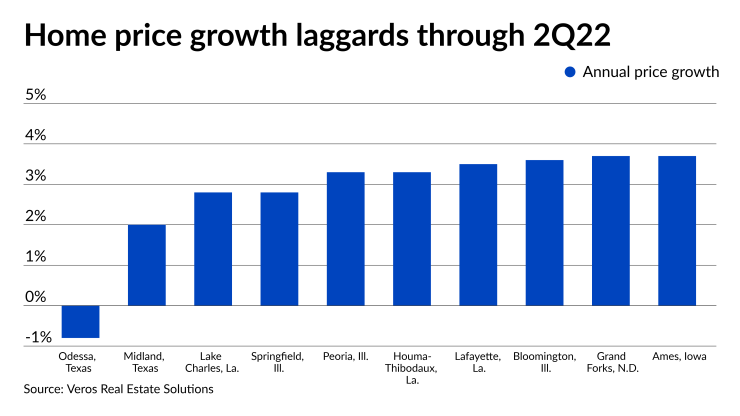

However, not all markets are benefiting from rising values, with several of the lower performers in areas reliant on the oil and petroleum business.

The 7% average annual growth rate through the second quarter 2022 is unchanged from Veros'

Out of the top 10 markets in terms of price growth — all located in the West — four are located in Idaho and a fifth straddles Idaho and Utah.

At the other end of the spectrum, among the areas dependent on oil where price gains should be suppressed include Odessa, Texas with an annual price decline of 0.8%; nearby Midland, up 2%; Lake Charles, La., up 2.8%; Houma-Thibodaux, La., up 3.3%; and Lafayette, La., up 3.5%.

That list also includes Grand Forks, N.D., which while not in the Bakken region, is trying to attract businesses that work in the oil industry there; area prices are expected to rise by 3.7%.

The other laggards include three Illinois cities: Springfield, Peoria and Bloomington, as well as Ames, Iowa.