After the past year of

The credit rating agency estimated prices at the national level are overvaluing homes by 10.5% in the third quarter, which included 70% of metropolitan areas. Further, the report showed 40% of markets overshot their value by 10% or more, compared to a 4% pre-pandemic share.

Every one of the 20 most populated housing markets experienced unsustainable annual growth at the end of the second quarter, compared to only two in the previous two years. Among the top 100 metro areas,

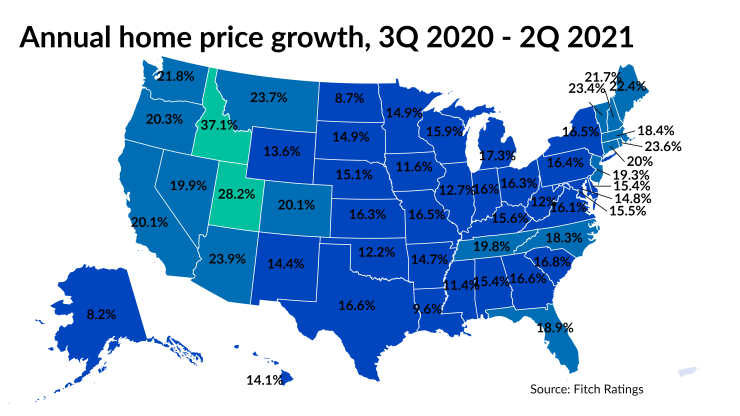

Fitch also found that only eight states— Alaska, Iowa, Illinois, Louisiana, Mississippi, North Dakota, West Virginia and Wyoming — experienced sustainable annual appreciation by the end of the second quarter. They all saw year-over-year price growth below 14%. Meanwhile, the highest rates of appreciation took place in Idaho at 37.06%, Utah at 28.22%, and Arizona at 23.88%.

While the extreme imbalance of supply and demand stoked the elevated appreciation, the underlying market fundamentals point to the rate of growth slowing down moving forward, the report said. Home

Additionally, inventory could be on the rise