The pace of home price growth slowed again in the first quarter compared to its

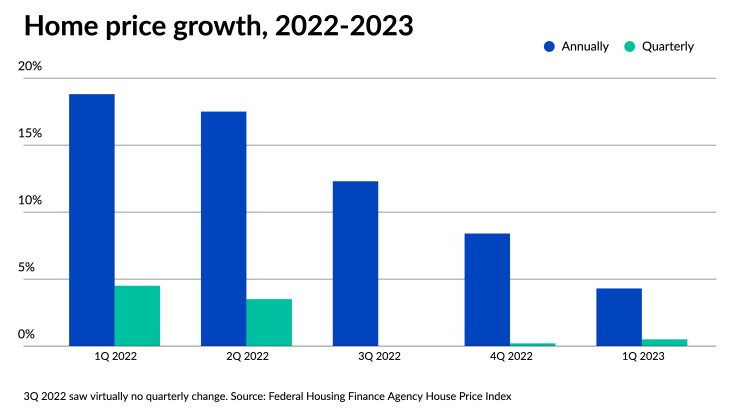

The FHFA's House Price Index climbed up 4.3% on an annual basis in the first three months this year, cooling from 8.4% in the fourth quarter of 2022. The latest number shows further slowing from the red-hot pace set a year ago, when home values surged by almost 19% from the year before, the largest upswing in recent memory.

The combined impact of

"U.S. house prices generally increased modestly in the first quarter" said Anju Vajja, principal associate director in FHFA's division of research and statistics, in a press release. "However, year-over-year prices in many Western states have started to decline for the first time in over ten years."

Among the seven U.S Census divisions, the Pacific and Mountain regions, both located in the Western U.S., were the only two that showed prices depreciating annually. Values fell 2.4% and 0.1% in Pacific and Mountain divisions, respectively.

Seven states, many of whom saw their housing markets soar the most during the pandemic purchase boom, posted a decline in prices compared to a year ago, with Utah seeing the largest fall of 4.3%, followed by Nevada and California at 3.6% and 2.9%.

The FHFA findings largely mirror the trends reported by other researchers,

On the other end of the spectrum, though, property values in the South Atlantic division continue to show strength, with prices rising 7.2% in the first quarter, the FHFA said. South Carolina led the nation in the pace of home price growth, up 9.5% since the first three months of 2022. Prices in neighboring North Carolina surged almost as much, rising 9.4%. Maine rounded out the top three with 8.9% annual growth.

On a quarterly and monthly basis, national home prices also headed upward, running

Whether more recent trends represent a leveling off of prices nationally is still in question, other data released this week shows housing costs moving in the same direction at an even more rapid pace. The monthly change recorded by the FHFA was a smaller increase than the rise in the CoreLogic S&P Case-Shiller Index, which was also released this week. Case-Shiller saw prices head up 1.3% between February and March, showing "counterintuitive strength," according to CoreLogic Chief Economist Selma Hepp.

"The very meager inventory of existing homes is putting buyers in a position of having to pay over the asking price, and as a result, driving early spring price gains well beyond what is traditionally seen during this period," she said in a statement.