It will take several years before the supply of homes for sale returns to pre-pandemic levels, but the market will likely get there by the end of 2024, according to the majority of experts surveyed by Zillow.

Meanwhile, the share of purchases from first-time home buyers, which diminished in ongoing

In the Zillow Home Price Expectations Survey, 79% of respondents predicted that monthly inventory levels should return to an average of 1.5 million houses for sale by the end of 2024. A substantial portion, 41% of the 109 people surveyed, were even more optimistic and think monthly supply will reach that level by the end of 2023. The total inventory of available homes has fallen from a monthly average of 1.6 million units in 2018 and 2019 to just over 1 million last year, according to Zillow, with monthly data in 2022 thus far showing numbers coming in even lower.

"We are seeing new listings returning to the market, slowly, as we enter the hottest selling season of the year, but this supply deficit is going to take a long time to fill," said Jeff Tucker, senior economist at Zillow, in a press release.

But housing costs, driven by the lack of homes for sale and the resulting rising appreciation of them, will remain a thorn in the side of buyers, with prices having increased by 32% in the past two years. While price acceleration should slow, home costs will still present an obstacle for potential buyers. For 2022, Zillow’s panel revised its expectations upward for home-value growth to 9% after previously predicting prices to rise by 6.6% in a survey taken at the end of 2021.

"Inventory and mortgage rates will determine how far and how fast home prices will rise this year and beyond," Tucker added.

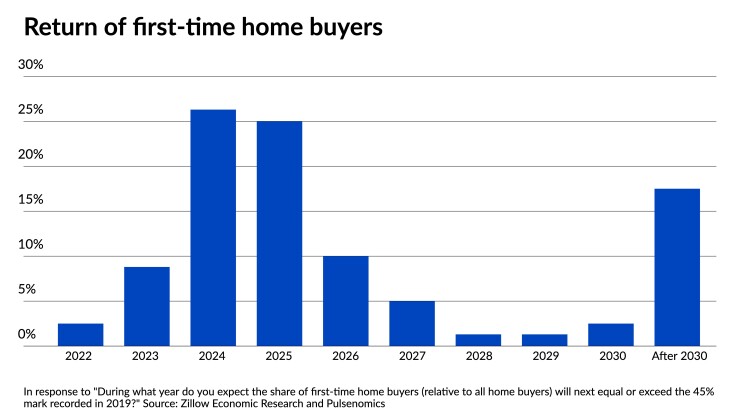

The housing market of the previous two years left some first-time home buyers on the outside due to the

The latest rise in

For the housing markets, it means 2022 may look more like 2021 before noticeable relief appears. "Against the backdrop of tightening Fed policy and increasing mortgage rates, this more bullish outlook for home values suggests that home inventory shortages will remain the dominant price driver this year," said Terry Loebs, founder of Pulsenomics, who conducted the survey on behalf of Zillow.