Many American homeowners count on the equity in their property to help fund their retirement years, but they might be overconfident by relying on that, according to fintech company Unison.

A 70% majority of those surveyed felt their home would be worth more by the time they retired, with 64% of this group stating the expected increase is important to their retirement plans.

But the Great Recession showed that

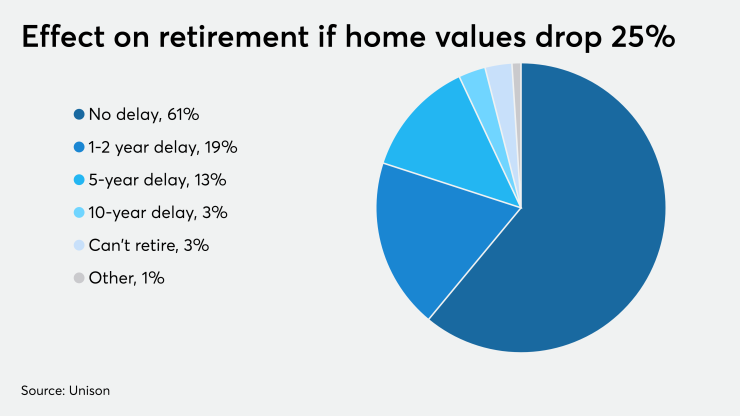

While 61% of respondents said a 25% drop in the value of their home would not affect their retirement plans, 19% said it would cause their retirement to be delayed a year or two, 13% said it would result in a five-year delay, 3% said a 10-year delay and 3% said they would be unable to retire.

For a large number, their home is a significant portion of their personal net worth: 26% tied more than half their total net worth to their home while 32% said their home represents between 25% and 50%. For an additional 28% it's 5% to 25%.

"For many American homeowners, the home is their largest financial asset and should therefore be at the core of their financial planning, including planning for retirement," Unison CEO Thomas Sponholtz said in a press release. "But most homeowners don't understand how to appropriately include this major asset, and the risk that comes with it, in planning for the future."

"The extent to which homeowners, especially baby boomers, are financially underprepared for retirement is a concern. And the problem cannot be solved without including the home in financial plans."

Unison provides an alternative to home equity or

Nearly nine of the 10 people surveyed by Unison plan to use their home as a financial asset, with nearly one-quarter of them counting on it to fund their retirement.

Approximately 20% said they plan to use the equity built up in their current home to purchase a better home. And 8% of the respondents expected to take out a

That equity represents a large share of the retirement nest egg of those planning to tap it or

On the other hand, only 28% of the respondents already reduced their property's equity, with 52% using a HELOC, 38% through a home equity loan and 21% taking cash out in a first mortgage refinance (some may have tapped equity on more than one occasion).

The survey also found 70% of those homeowners count on Social Security as another source to fund their retirement, while 62% count on a private sector pension plan. But both sources are not exactly seen as stable.

"In the United States, if there's $30 trillion of residential real estate, about $15 trillion is mortgaged and about $15 trillion is equity owned by 132 million individual homeowners," Sponholtz said. "Imagine if you make that $15 trillion of equity that's locked up in homes liquid, so that equity becomes part of the homeowner's active net worth."

The online survey, conducted in August 2019 by Dynata for Unison, consisted of 2,000 homeowners from a geographically representative national sample balanced across gender and age groups. Participants had to have owned their home for at least 10 years and an annual household income of $50,000 and not yet retired.