As home value appreciation keeps churning, the share of those upside down on their mortgage grows smaller than ever, according to CoreLogic's Home Equity Report.

Homeowners with mortgages — a group constituting about 64% of all properties — saw their equity

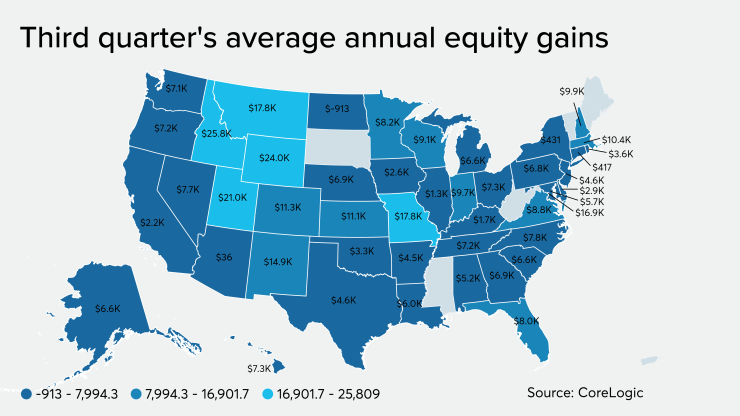

Home equity grew in 44 of the 50 states, but those in the Mountain West increased the most. Idaho led all states, with its homeowners gaining an average of $25,809 in equity. Wyoming and Utah joined as the only other states with gains above $20,000, as homeowners increased their equity by an average of $23,975 and $21,043, respectively.

The continual growth of housing prices helped push up equity and lowered the percentage underwater. North Dakota was the only state with equity depreciation at -$913, while Maine, Mississippi, South Dakota, Vermont and West Virginia had insufficient data.

"The negative equity share continues to decline thanks to

Negative equity — those underwater, owing more on their loans than the value of their home — declined 10% year-over-year in the third quarter to 2 million homes from 2.2 million, or 3.7% of properties with mortgages. Negative equity dropped 4% from the prior quarter. Negative equity peaked in the fourth quarter of 2009 at 26% of all mortgaged properties.

"Ten years ago, during the depths of the Great Recession, more than 11 million homeowners had negative equity or 25% of mortgaged homes," said Frank Nothaft, chief economist for CoreLogic, "After more than eight years of rising home prices and employment growth, underwater owners have been slashed to just 2 million, or less than 4% of mortgaged homes."