An increasing number of consumers found the home buying landscape more unwelcoming than ever in June, as

The share of borrowers who thought it was a good time to buy a home dropped to a new Fannie Mae Home Purchase Sentiment Index all-time low of 32%

Despite the largely unfavorable conditions,

“Despite the pessimism in home buying conditions, we expect demand for housing to persist at an elevated level through the rest of the year,” Fannie Mae SVP and chief economist Doug Duncan said in the report. “Mortgage

On the other side of that coin, 77% of consumers said June was a good time to sell — another survey record — compared to 15% who said it wasn’t. The net positive 62% increased from 42% in May and from -7% in June 2020.

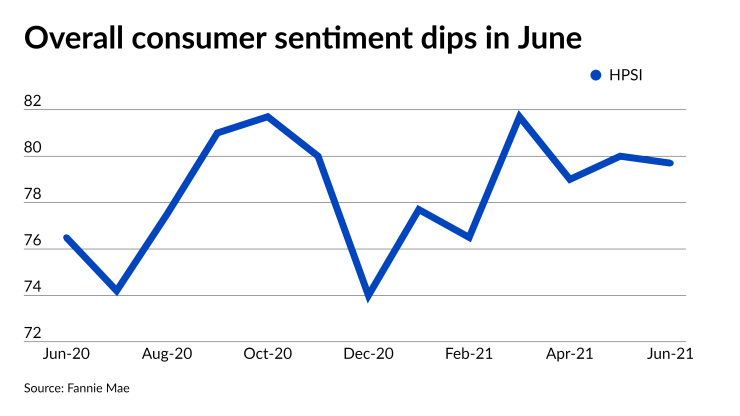

The overall home purchase sentiment score edged down to 79.7 from 80 in May while staying above 76.5 year-over-year. A 77% net share of respondents weren’t concerned about job loss, up two percentage points monthly and 29 percentage points annually. Meanwhile, a net 14% reported significantly higher household income over the past 12 months, down two points from May and up five points from June 2020.

A net 49% expect mortgage rate growth in the next year, down from 57% in May, but up from 85% a year earlier. Lastly, a net 27% of consumers expect home prices to rise in the next 12 months, a decline from 30% month-over-month while rising from 9% year-over-year.