Housing affordability dropped in April at the fastest pace since December 2018 and won’t be improving any time soon, according to First American.

The Real House Price Index — a metric that adjusts residential property prices for income and interest rate fluctuations — grew 0.7% from March and 7% year-over-year. When RHPI rises, home buyer affordability falls. Median household income increased to $74,249 from $73,455 monthly and $70,542 annually while house-buying power jumped to $505,904 from $499,060 the month before and $465,906 in April 2020.

Despite purchasing power increasing for the 16th straight month, it didn’t keep up with the 16.2% home price growth from a year ago, a likely trend moving forward. Those growth rates need to flip in order for consumer affordability to increase but a combination of

Under current conditions, household income would need to increase by 5% to offset the

“While nominal house price growth may moderate due to the affordability

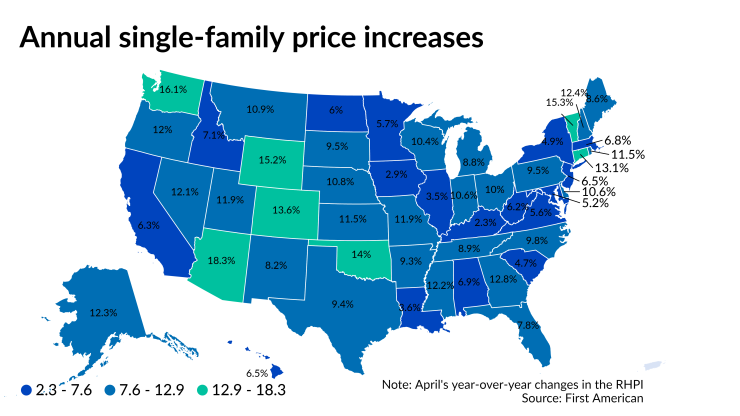

Arizona led all states with an annual rise of 18.3% in RHPI, outpacing Washington’s 16.1%, Vermont’s 15.3% and Wyoming’s 15.2%. No states experienced year-over-year RHPI decreases in April but Kentucky had the lowest growth at 2.3%, followed by 2.9% in Iowa and 3.5% in Illinois.

Among the 50 largest housing markets, RHPI grew the most annually in Phoenix at 20.8%, Kansas City, Mo., at 20.52%, Seattle at 18.21% and Tampa, Fla., at 16.55%. Only San Francisco fell from April 2020, declining 0.68%, then came increases of 0.43% in Riverside, Calif., and 1.74% in Miami — modest gains that make home