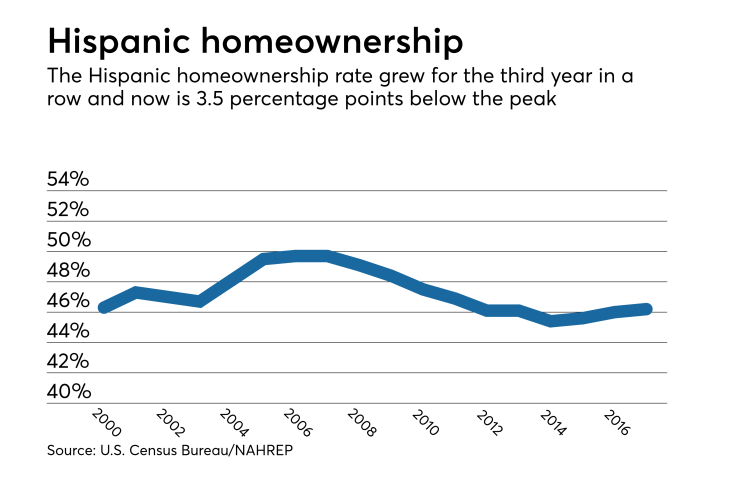

Despite concerns about U.S. immigration policy and housing inventory shortages, the Hispanic homeownership rate increased for the third consecutive year in 2017.

The rate increased to 46.2% from

In addition, 2017 ended with the highest number of Hispanic homeowners, at 7,472,000 units, up by 167,000 from 7,305,000 units one year ago, which was the previous high. This can be attributed to overall population growth among Hispanics in the U.S. The report cites U.S. Census Bureau data for its findings.

The overall homeownership rate is 63.9% for 2017, up from 63.4% in 2016, according to the report. The 2007 homeownership rate for the general population was 68.1%.

"We see from the report's data the strong enthusiasm for homeownership within the Hispanic community," said NAHREP President Daisy Lopez-Cid in a press release accompanying the report. "With a growing Hispanic population and the highest rate of workforce participation, Hispanics are expected to drive growth in the housing market for decades."

Besides inventory and immigration, natural disasters also were a negative factor that inhibited homeownership growth among Hispanics last year, NAHREP said. But those problems "are short term and solvable," the report said. "The Hispanic segment's influence on U.S. homeownership gains is based on the long-term impact of their combined workforce, economic and aspirational contributions, which are expected to continue to drive homeownership for the foreseeable future."

The U.S. Hispanic population grew by 1.1 million in 2017, and is now at 58.6 million people. But the three states hardest hit by natural disasters last year — California, 15.3 million; Texas, 10.9 million; and Florida, 5.1 million — account for more than half of that total.

The Hispanic labor force participation rate is 66.1%, higher than any other racial or ethnic demographic, the report states.

Hispanics accounted for 265,000 new household formations last year, or 28.6% of the total. In 2016, there were 340,000 new Hispanic household formations.

The slight decline in formations could be attributed to that half the Hispanic population resides in high housing cost states, the report said.

Immigration policy has been a drag on Hispanic homeownership since President Trump assumed office. Last June,

"The volatility surrounding immigration reform can have an escalating impact on Hispanic consumer appetite to make the long-term financial commitment required for homeownership," the report said.

Meanwhile, the inventory shortage hit the low-end of the housing market the hardest, which has

But 81% of the Hispanics surveyed said owning a home was a good long-term investment, similar to the 82% of the general population.

There were three obstacles cited by Hispanics in that survey to obtaining a mortgage: having an insufficient credit score or history; not being able to afford the down payment and/or closing costs; and not having sufficient income for monthly mortgage payments.