Loan volume and balances increased in the third quarter as costs stabilized, according to data from the Mortgage Bankers Association.

The average production volume per company during the third quarter was $764 million, up from $654 million in the second quarter, according to the MBA's Quarterly Mortgage Bankers Performance Report released Wednesday. By loan count, volume rose from 2,721 to 3,072 between the second and third quarters.

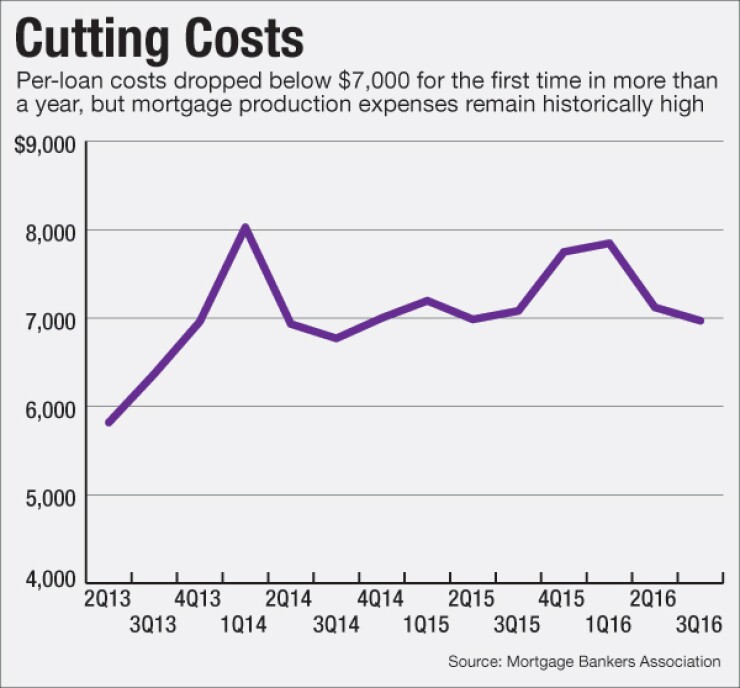

Costs per loan totaled $6,969 during the third quarter, marking the first time since the second quarter of 2015 that this figure dropped below $7,000. In the second quarter, total loan production expenses were $7,120.

"An increase in production volume and slight decrease in expenses in the third quarter kept production profits relatively stable," said Marina Walsh, MBA vice president of industry analysis, in a news release.

While lower costs proved beneficial, the decrease does not mean that costs are low from a historical perspective. Loan production expenses have averaged $5,850 per mortgage for the period between the third quarter of 2008 and now.

"Given the increase in loan count and the higher pull-through rate compared to the second quarter, we would have expected an even larger reduction in production expenses," Walsh said.

Loan balances also increased, reaching a study-high of $247,563. The expansion in loan balance helped to prop up production revenue figures, according to Walsh.

"Loan balances continued their upward march and…helped keep production revenue per loan relatively flat despite a revenue drop in basis points from the previous quarter," Walsh said.

The average pretax production profit per loan only expanded by a single basis point from the second quarter to 74 basis points. A year ago, production profits were 55 basis points.

On a dollar basis, the MBA reported a net gain of $1,773 per loan originated by an independent mortgage bank or mortgage subsidiary of a chartered bank, up from the reported gain of $1,686 per loan in the second quarter. The MBA added that 94% of lenders in the study reported pretax net financial profits versus 90% the previous quarter.

Total production revenue dropped to 365 basis points from 373 basis points a quarter earlier. Net secondary marketing income fell as well, due to lower income from mortgage servicing rights, which kept profits from rising even higher.