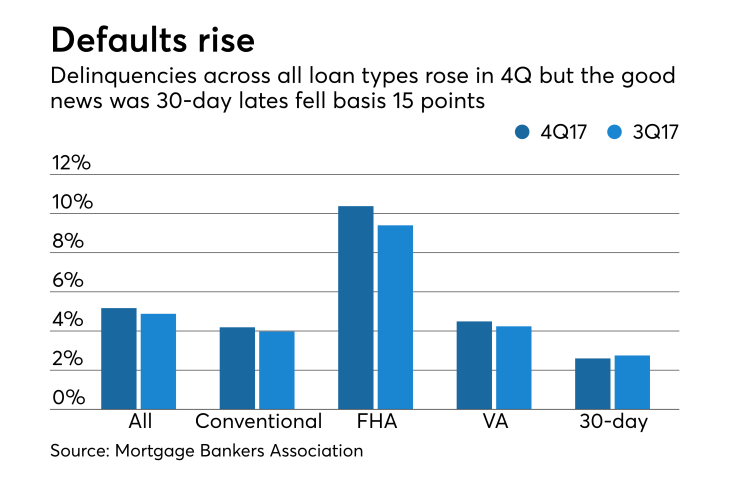

There was an increase in total mortgage defaults during the fourth quarter but that rise has to be measured in context of what had been a favorable environment prior to the third-quarter storms.

While the delinquency rate increased 29 basis points to a seasonally adjusted 5.17% from the third quarter, those increases followed what had been a historic low of 4.24% in the second quarter, said Marina Walsh, the Mortgage Bankers Association's vice president of industry analysis, during the group's servicing conference in Dallas.

The delinquency rate was 4.88% in the third quarter and 4.8% one year prior.

The 30-day delinquency rate was down 15 basis points to 2.6% between the third and fourth quarters, the 60-day and 90-day rates were up 9 basis points to 0.92% and 35 basis points to 1.65%, respectively, which she attributed to the aftermath of the storm.

Borrowers with Federal Housing Administration loans were particularly affected by the storms, as the overall rate increased 98 basis points and the 90-day delinquent rate increased 75 basis points from the third quarter.

"We can't panic because at the second quarter of 2017, we were at a record low" default rate for FHA and all loan types, Walsh reiterated.

There could be other factors as well to that increase, including lower credit scores and rising debt-to-income ratios for FHA borrowers. Given those factors, it wasn't surprising there was an increase in FHA defaults, Walsh said.

Texas is further along in its recovery than Florida, she said. In Texas, the 30-day delinquency rate was 3.4% for the fourth quarter, down from 4.65% in the third, but the 60-day rate was up to 2.35% from 1.41% and the 90-day rate was 1.37% from 1.29%.

But the increase in delinquencies for Florida loans was greater for the 60-day and 90-day categories. The percentage of 30-day delinquent loans fell to 2.78% from 4.64%, while for 60-day delinquencies, it increased to 4.47% from 3.46% and for 90-day it went to 1.65% from 0.93%.