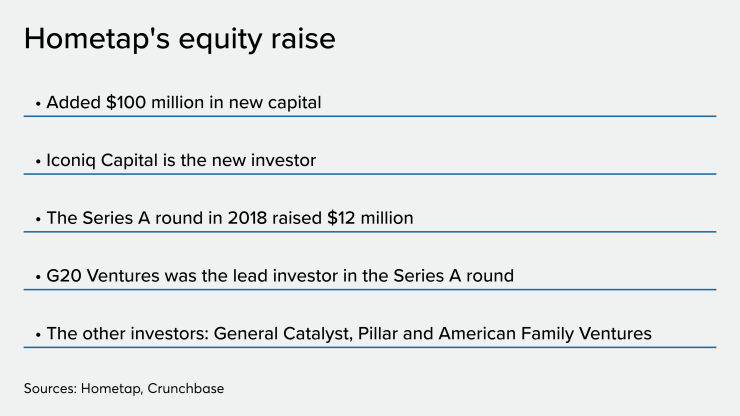

Hometap, a fintech company providing an alternative to traditional home equity lending, secured $100 million in new financing as it looks to expand its geographic reach.

The capital raise added Iconiq Capital as a new investor. Other participants in the new raise were current investors General Catalyst, G20, Pillar and American Family Ventures. Those four companies participated in a Series A round in April 2018 that raised $12 million, according to Crunchbase.

Hometap allows homeowners to access a percentage of their property's current value in exchange for an agreed upon percentage of its future value. The benefit, the company said, is that owners are able to tap into their home equity without the stress of monthly payments and interest they would incur if they added debt through an open-end or closed-end loan.

"We are thrilled to be investing with Hometap. With a highly transparent, customer-first approach, they are providing a valuable solution to the challenges faced by many homeowners," Nugi Jakobishvili, Iconic's chief investment officer, said in the press release.

In May, Hometap operated in six states, reaching 20% of the nation's homeowners. Its goal is to eventually reach 75% of homeowners.

"We've been working diligently toward our mission of making homeownership less stressful and more accessible for as many U.S. homeowners as possible, and we've had tremendous success thus far," said Hometap CEO Jeffrey Glass, CEO of Hometap. "But the fact remains that the vast majority of homeowners are currently feeling 'house rich and cash poor' and there's a lot more work to be done to make home equity investments an option that's available to everyone."

Another home equity alternative, Point,

The market could be ripe for Hometap. A

However, Hometap's product competes with first mortgages in today's environment. With

According to a recent Black Knight report, American homeowners had

The mortgage vintage with the highest prepayment rate in October was 2018, at 3.82%, Black Knight said. Next was 2014 at 1.95%.

Meanwhile,