HECM lenders began the year on an upswing, with endorsements industry-wide increasing by 10.5% on a monthly basis in January, according to Reverse Market Insight. Numbers also grew across the majority of the top 10 reverse mortgage companies according to a ranking by RMI.

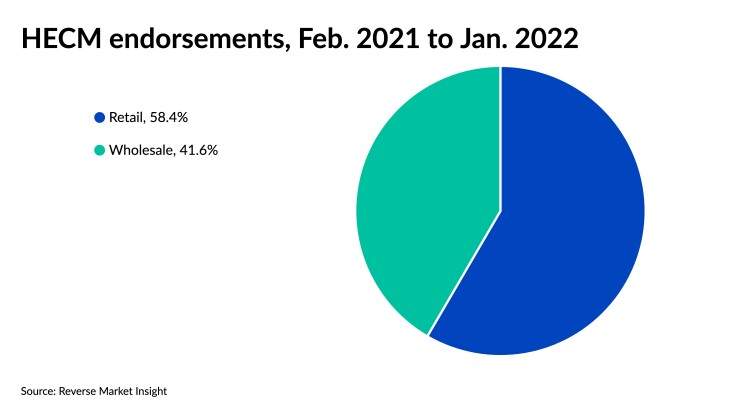

The total number of endorsements for the Federal Housing Administration-backed reverse loans increased to 5,763 from 5,214 in December. In retail channels, volumes jumped up by 13.3%, rising to 3,313 from 2,925 month-over-month, while wholesale endorsements rose by 7% to 2,450 from 2,289. Endorsement volumes over the past twelve months equaled 54,179, with a breakdown of 31,646 and 22,543 between retail and wholesale.

“When we look at the numbers, we see that HECM counseling sessions industry-wide jumped in the month of January compared to previous months. These FHA-mandated sessions are a good leading indicator to HECM production,” said Joe DeMarkey, strategic business development leader at Reverse Mortgage Funding, in an emailed statement to National Mortgage News. Counseling sessions increased by 20% on a monthly basis in January and 50% from the same month a year earlier, he noted.

Industry leader American Advisors Group, who leads the reverse mortgage market with a one-third share, saw a 5.3% gain in endorsements to 1,655 from 1,568. However, the second-largest company, Finance of America Reverse, saw a monthly loss, with new endorsements falling 19% to 799 from 982 in December. In third place was Reverse Mortgage Funding, whose numbers increased 27% between December and January from 415 to 526. Rounding out the top five were Longbridge Financial and Liberty Reverse Mortgage, both of whose numbers increased by double-digit percentages on a monthly basis at 47% and 18%, respectively. Eight out of the leading 10 reverse lenders saw endorsements increase in the first month of the year.

Contributing to the heightened interest in reverse mortgages was an

The rule change coincides with research over the past several months, which shows that

The reverse mortgage market space saw renewed interest over the past 12 months among many lenders, with new hires at several companies that over the product, including Cherry Creek Mortgage. The Denver-based lender decided to sell an aging HECM servicing portfolio and introduced a new reverse division at the close of 2021, assembling a team of managers to scale operations. Efforts helped bring about a 303% year-over-year increase in January originations, which totaled 117, they said.

“Our 2022 goal is focused on growing reverse mortgage retail, wholesale and closed loan seller opportunities while building out a new reverse mortgage servicing portfolio,” said Bruce Barrnes, managing director of Cherry Creek’s reverse division, in an email to National Mortgage News.