The majority of borrowers impacted by

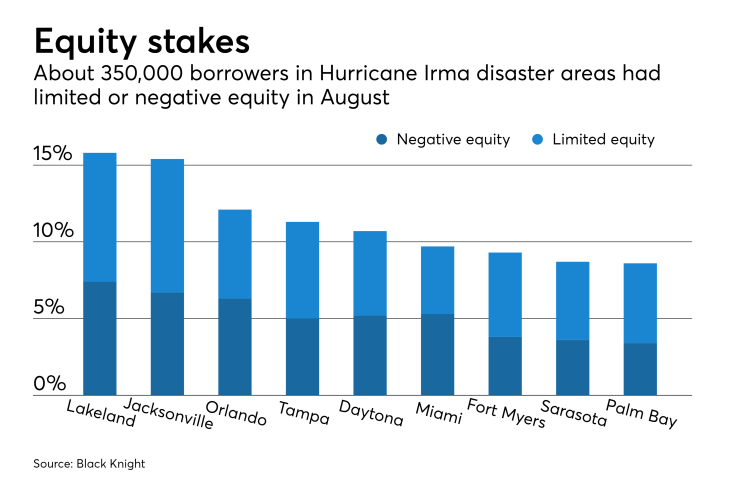

Less than 0.5% of borrowers impacted by Hurricane Harvey were in negative equity positions before the storm hit, and less than 4% have below 10% equity. Regarding borrowers in counties impacted by Hurricane Irma, 5.3% still owe more than the value of their home, and an additional 5.6% have less than 10% equity.

Nationwide, 1.4 million borrowers, or 2.8% of homeowners with mortgages, had negative equity in August.

"Before Hurricane Harvey made landfall, the average combined loan-to-value ratio for homeowners with mortgages in what became FEMA-designated disaster areas was 53%. Right on par with the national average, that's the lowest we've seen since prior to 2004," Ben Graboske, Black Knight's data and analytics executive vice president, said in a press release.

"This equates to approximately $131,000 in equity per borrower. That works out to a lot of skin in the game, and will likely serve as strong motivation for borrowers not to walk away from a storm-damaged home," he continued.

Notably, more than 75% of mortgages for properties in Harvey-affected areas are held in Fannie Mae, Freddie Mac or

In Florida, the 48 FEMA-declared Irma disaster areas include

Unlike Houston, where higher-than-ever home prices have helped reduce negative equity, Florida home prices are 17% below their 2006 peak.

"Of the 3.2 million borrowers impacted by Irma, an estimated 170,000 were still in negative equity positions before the storm, with another 180,000 having less than 10% equity in their homes," said Graboske. "Due to lackluster home price recovery since the housing crisis, the negative equity rate in Irma's disaster area is nearly twice the national average."