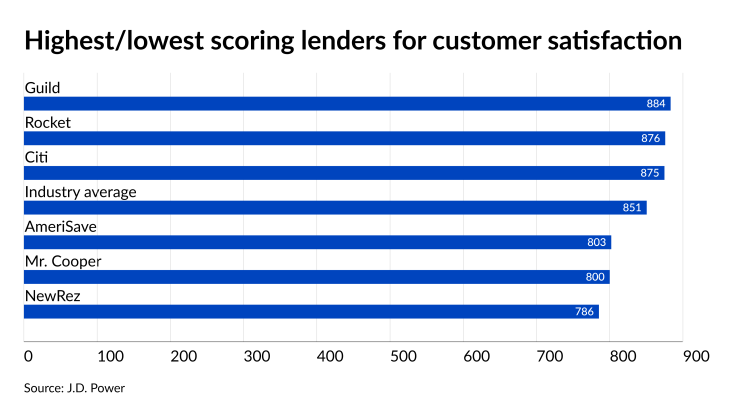

Guild Mortgage has supplanted Rocket Mortgage as the mortgage originator with the highest customer satisfaction score — but consumers marked down the industry as a whole as lenders struggled to handle the surge in refinancings, J.D. Power said.

In its 2021 U.S. Primary Mortgage Origination Satisfaction Study, the industry average score fell to 851 from

For younger generations of borrowers who grew up almost exclusively doing things on a mobile device, the natural assumption is that they desire an all-digital process.

"Well, that's not necessarily the case," said Jim Houston, managing director of consumer lending and automotive finance intelligence at J.D. Power. "There are places within the journey, especially when you talk about big- ticket items like a mortgage, my largest payment I'm going to have going forward in life, I do want or need or feel like a little live, personal service helps me along the way."

The study found that more than three-fourths (76%) of Gen Y and Gen Z mortgage customers who use both live personal service and digital self-service channels during the application and approval process said they "definitely will" consider that same lender for their next refinance. That falls more than 10 percentage points when only one of these two channels is used.

"What we're seeing in the data is this desire, need or want to have a tailored journey," Houston said. "It's the combination that consumers want more of a personalized journey versus just send me down … the path that's easiest for you or this is what you think is the best for me."

The market has moved outside of what was seen as the traditional homebuyer of the married couple, so giving customers the tools necessary will help originators get the win, although Houston added, rates will remain a strong influence as well in the choice of a lender.

"But as long as your organization has a customer- centric approach to begin with, it's not all about the volume," he said. "That's where we see the brand; these high performers rise up from a brand image perspective as well."

When it comes to refinances, honesty is the best policy in terms of timelines to close the transaction, especially in communicating expectations upfront.

As long as the lender provides the client with an expectation of time to close and what it looks like, "they're just as happy as if you have the fastest close time in the marketplace," Houston said.

Meanwhile, Guild scored 884 points in this year's survey, after not having enough consumer responses to qualify for the 2020 survey, although it's been a leading scorer in previous years.

Rocket was next at 876, down from 883 in 2020. It's the first time in 12 years that it did not receive the highest mortgage originator customer satisfaction score. Although in the 2017 survey, Guild and what was then known as Quicken Loans

Chase, tied for No. 2 overall last year, had a huge reduction in its customer satisfaction score, 843 from 860 in the 2020 survey. Bank of America, which tied with Chase a year ago, only had a one-point decline to 859. That put it in sixth place this year, behind Citi (875), CrossCountry Mortgage (874) and Fairway Independent (871).

NewRez, which also did not have enough for last year's rankings, had the lowest score at 786. Mr. Cooper had a 32-point drop in the satisfaction score to 800 points, while AmeriSave Mortgage, also not in last year's survey, scored 803.

PennyMac, last year's low scorer, had a 54-point increase this year to 827.