Fannie Mae and Freddie Mac will start requiring mortgage lenders to use the new uniform residential loan application late next year.

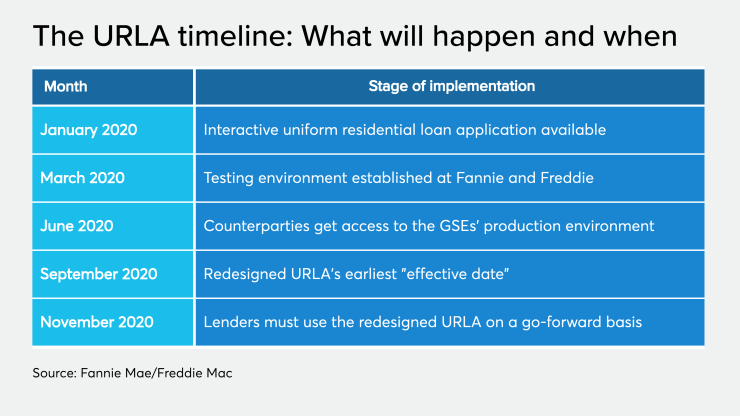

Use of the new URLA will be mandatory for loan submissions starting Nov. 1, 2020. Prior to that date, lenders can use older versions of the application, commonly referred to as the Fannie Mae 1003 form. Files submitted using legacy automated underwriting system specifications will no longer be accepted after Nov. 1, 2021, when a pipeline transition period ends.

The GSEs expect to make the interactive version of the URLA available in January 2020. They plan to have a test environment for the new form up and running by March of next year and subsequently begin implementation with limited production over the summer. Lender submissions can begin in September.

The URLA might have been implemented a lot sooner if the GSEs’ regulator had not wavered over the course of time on the question of whether to add a language proficiency question or not.

The Federal Housing Finance Agency, under current Director Mark Calabria, determined

Watt had initially decided against adding a language proficiency question back

Although the FHFA ultimately decided to remove the language proficiency question, it has continued to support