Goldman Sachs affiliate MTGLQ Investors won another bid for Fannie Mae's nonperforming loans, persisting as a buyer for the product even as Fannie keeps working to diversify the investor base.

The company purchased four pools of loans totaling more than $1.6 billion on an all-or-none basis. Bids for the pools are due June 19.

The Goldman affiliate has been foremost among buyers of Fannie's NPLs for years although it has been less prominent since housing groups criticized the government-sponsored enterprises' practice of selling loans

Since then, sales to the company and its peers have alternated with sales of smaller Community Impact Pools to buyers like community development financial institutions and nonprofits. Fannie last month, for example, marketed more than $1.7 billion in nonperforming loans as a Community Impact Pools.

"There have been a number of nonprofits that have expressed an interest in trying to acquire nonperforming mortgages in their area" in response to the Community Impact Pools, Wayne Meyer, president of CDFI New Jersey Community Capital, said in an interview earlier this year. His company has purchased Community Impact Pools in partnerships with other nonprofits.

Nonprofits look to repurpose the collateral properties as affordable housing whereas other investors may not, although part of the motivation for the Goldman affiliate is the fulfillment of its multibillion-dollar crisis-era mortgage securities settlements, which include affordable housing requirements.

Goldman earlier this year surpassed the halfway mark in fulfilling those obligations, according to a recent settlement monitor's report.

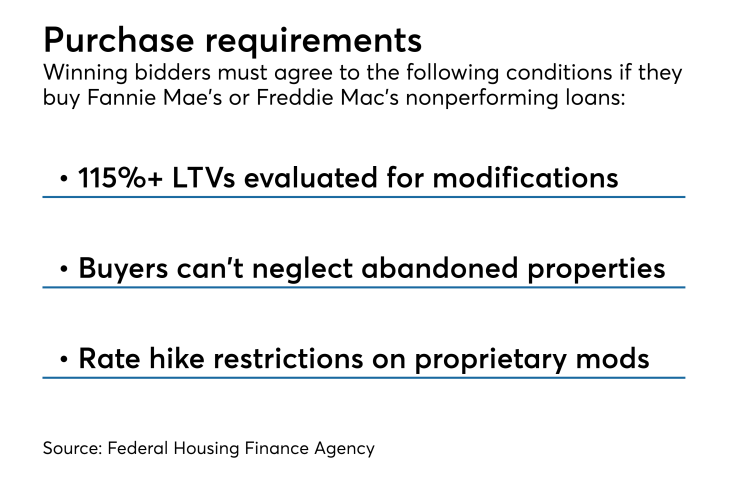

Any investor in the government-sponsored enterprises' nonperforming loans must agree to evaluate underwater borrowers with loan-to-value ratios that are above 115% on a mark-to-market basis for modifications.

Also if the property is abandoned, the buyer can't walk away from it and neglect it, and proprietary modifications must be made in line with certain parameters designed to prevent the borrower's payments from escalating too steeply.

NPL sales help the government-sponsored enterprises manage the credit risk on their balance sheets, something that may come under closer scrutiny due to new