Ginnie Mae's latest initiative in support of the use of e-notes could finally lead to widespread use of digital closing software, some experts say.

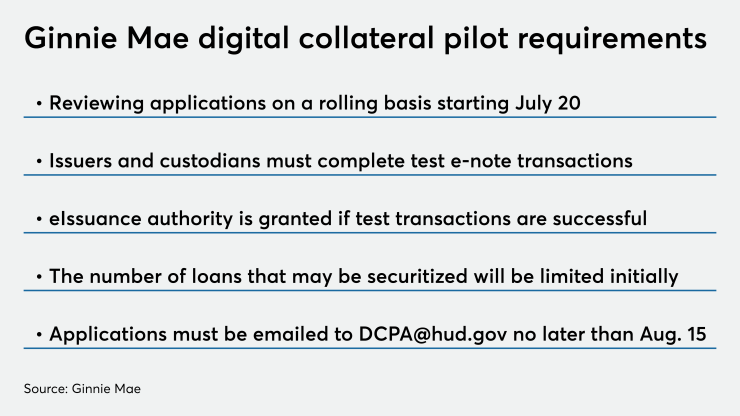

Starting Monday, Ginnie Mae will allow mortgage companies to apply to be among its first "e-issuers" as the government agency introduces the use of e-notes and other digital loan files as collateral for securitizations it insures. The move follows a

Issuers approved for the program will receive written authority to use "digital collateral" for a limited number of securitizations if initial test transactions with document custodians are successful. Applications must be emailed to DCPA@hud.gov no later than Aug. 15.

The move could go a long way toward increasing the percentage of loans for which digital closing strategies can be applied, said Armando Falcon, a former government-sponsored enterprise regulator and the chairman and CEO of a business advisory firm that works with Ginnie Mae.

"Up until this point, the use of e-notes and remote online closings was primarily driven by Fannie Mae and Freddie Mac, but that wasn't enough for most market participants to justify the investment in the technology or infrastructure," Falcon said. "With roughly 30% of loans originated in the U.S. issued into Ginnie Mae's MBS program … it finally makes sense for more and more mortgage companies that were watching from the sidelines to make this transition."

Digital closings were already

"When it comes to ROI for mortgage companies, it's going to come down to the ability to implement digital … closings at scale before you can see any significant numbers come to fruition," said Camelia Martin, a managing director and leader of Falcon Capital Advisors' digital mortgage advisory group. "Ginnie Mae's digital collateral program makes this type of scale within reach for more lenders."

To date, a relatively small number of mortgage companies have employed e-notes, which establish the right to collect borrowers’ debt. The companies involved have tended to be larger players, but not exclusively so. Early adopters have included

Widespread adoption is dependent not only on mortgage companies and the government-related agencies that buy or insure their loans, but also warehouse lenders that provide temporary funding for home loans prior to securitization.

E-note adoption rates in all these areas have slowly improved over time, as more players have signed on to use the automation and technology providers have developed products aimed at serving the needs of a broader range of players.

"Ginnie Mae allowing lenders to use e-notes removes one more barrier to entry that mortgage companies that want to take advantage of this technology face," said Austin Kilgore, director, digital lending at Javelin Strategy & Research. (Kilgore is a former National Mortgage News editor-in-chief.)

"E-notes have matured and there is a lot more outside vendor support to help lenders participate and take advantage of this program than there used to be."

Lenders are more likely to be more receptive to e-notes now not only because Ginnie's move improves their potential ROI, but because they are looking for operational efficiencies that could help them keep up with an influx of

"Lenders should realize some long-term cost savings and be more nimble as organizations because of this," Kilgore said.