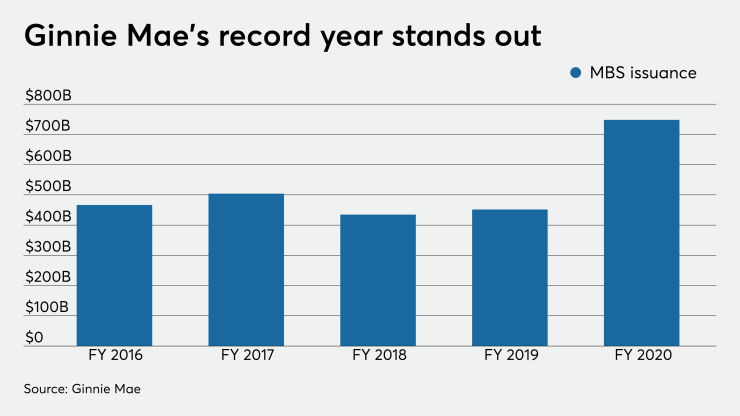

The white-hot originations market of 2020 drove Ginnie Mae's securitized mortgage volume to an all-time high, sailing well past its old record.

Ginnie closed its 2020 fiscal year by issuing $748 billion in MBS, eclipsing the $451.6 of FY 2019 and its previous record of $504 billion in FY 2017.

"Our business is elastic and our mission is based on meeting the needs of our insuring partners: The FHA, VA and USDA," a spokesperson from Ginnie Mae said in a statement to NMN. "

On a month-by-month basis, Ginnie's total issuance fell slightly to $75.76 billion in September

Ginnie Mae's annual record issuance helped over 2.8 million households secure affordable homes and rental housing — both single and multifamily — compared to 1.8 million the year prior.

"2020 is a year that will stand out in the record books for Ginnie Mae," Seth Appleton, principal executive vice president, said in a press release. "We attracted record capital to support affordable homeownership and rental housing opportunities for millions of American households, advanced key modernization initiatives, and responded swiftly to the COVID-19 national emergency, all while operating in a remote environment."

Ginnie's unpaid principal balance continued its upward trajectory, going over $2.1 trillion in FY 2020. The UPB totaled just under $2.1 trillion in FY 2019, $2 trillion in FY 2018 and nearly $1.9 trillion in FY 2017.

Because Ginnie-backed loans typically represent low-to-moderate income borrowers, they face higher forbearance levels compared to most other loan types. While the