With a debt deadline looming and regulators again delaying approval of its takeover by China Ocwenwide, Genworth Financial is weighing how to protect its private mortgage insurance unit from its troubled life insurance business.

The two companies again

They intend to refile the transaction "with additional mitigation approaches, including potentially working with a U.S. third-party service provider," according to a press release.

The mitigation is related to the CFIUS review of the deal, said Julie Westermann, a Genworth spokeswoman.

Of more immediate concern to Genworth Financial is $600 million of debt that matures in May 2018.

"Options to address the 2018 debt maturity in the absence of a transaction with Oceanwide include potential refinancing alternatives, current holding company cash, and/or potential asset sales," said Genworth Financial President and CEO Tom McInerney.

"We are also evaluating options to insulate our U.S. mortgage insurance business from additional ratings pressure in the absence of a transaction with Oceanwide."

Genworth does not comment on potential ratings actions or its conversations with ratings agencies, Westermann said.

The $2.7 billion deal was announced

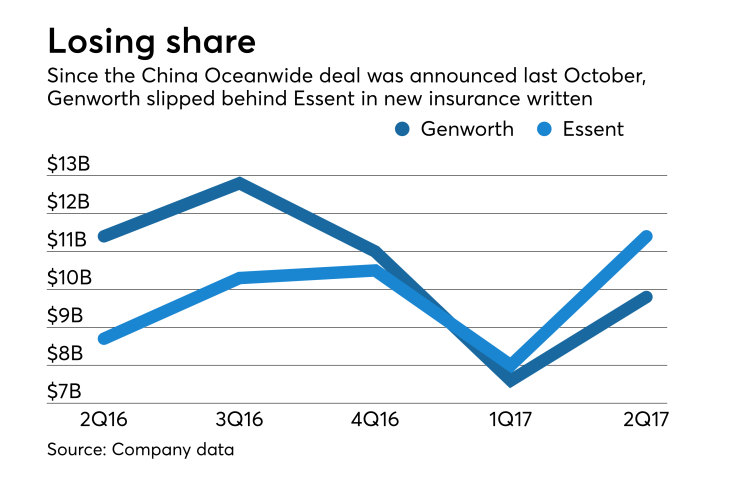

Since the transaction was announced, Genworth's U.S. mortgage insurance business has slipped behind Essent, one of the new companies started after the housing crisis, in terms of new insurance written.

In the first quarter, Essent became the fourth largest MI, with NIW of $8 billion, while Genworth did $7.6 billion. Genworth's second-quarter NIW was $9.8 billion, while Essent's volume was $11.4 billion.

Genworth has not yet refiled the CFIUS notice, unlike in July, when following the withdrawal a new notice was filed.

There is a 30-day review period that starts when the new notice is filed with CFIUS, which may be followed by an additional 45-day investigation period.

"Genworth and Oceanwide intend to actively engage in discussions with CFIUS with respect to mitigation options; however, there can be no assurances that CFIUS will ultimately agree to clear a transaction between Genworth and Oceanwide on terms acceptable to the parties or at all," the press release said.