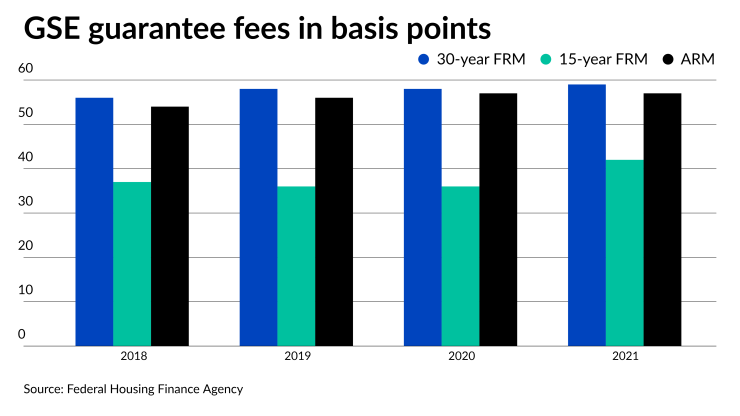

Average guarantee fees for residential mortgages sold to the government-sponsored enterprises increased by 2 basis points in 2021, reversing a decline by roughly the same amount the prior year, according to a new analysis of pricing from that period.

The average g-fee charged was 56 basis points, compared with

An increase in the average upfront fee was responsible for the gain, as that rose 2 basis points to 13 basis points. The ongoing guarantee fee was unchanged at 43 basis points.

Perhaps the most striking disparity highlighted in the report was the difference between the increase in the average g-fee for fixed rate mortgages with different terms. The g-fee for 30-year FRM rose 1 basis point to 59 in total. The equivalent for a 15-year loan increased by 6 basis points to 42.

"Fifteen-year fixed-rate loans are more likely to be refinance acquisitions compared to overall acquisitions," the FHFA noted in its report.

Average g-fees for rate and term refis rose by 3 basis points to 52. For purchase loans, they dropped 1 basis point to 55. The average g-fee for a cash-out refi fell 1 basis point to 65.

The average g-fee charged for adjustable rate mortgages was unchanged at 57 basis points.

The safest loans, those with the highest loan-to-value ratio, also saw an increase in 2021 because of the adverse market fee.

The average g-fee for a loan with an LTV at or under 70% increased 3 basis points to 53. The bucket between 71% and 80% LTV, a point where borrowers are not required to purchase mortgage insurance as a credit enhancement, had the highest fee, at 62 basis points, up 1 from a year earlier.

For mortgages with loan-to-value ratios between 81% and 90%, where MI is typically required for Fannie Mae or Freddie Mac to buy the loan, the g-fees rose by 1 to 55 basis points. But the riskiest bucket, above 90% LTV, had a 54 basis point average g-fee, unchanged from 2020.

In a similar vein, average guarantee fees for loans with a credit score below 660 decreased by 3 basis points to 79, a move FHFA attributed to lower average LTVs.

Average guarantee fees for loans with credit scores in the 660 to 719 range remained unchanged at 66 basis points. For mortgages with credit scores at or above 720, they increased by 2 basis points to 54.

The average g-fee was 56 basis points for the medium and small seller groups, and 57 for large players.

The GSEs are required by Congress to pass along 10 basis points of the fee to the Treasury to pay for a payroll tax cut, an obligation that

Going forward, some g-fees for affordability buyers