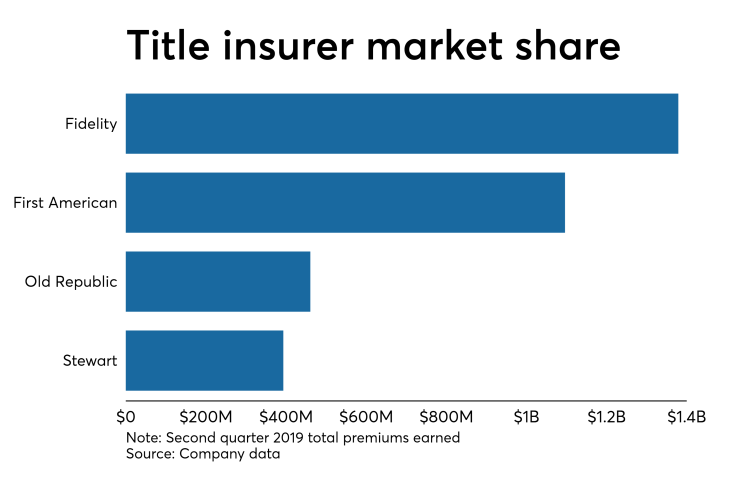

The Federal Trade Commission wants to block the merger of Fidelity National Financial and Stewart Information Services, stating the deal would reduce competition for title insurance, including for large commercial real estate transactions.

The transaction would also reduce competition in several local markets for title information service, the FTC said.

This is the second regulator to rule against the transaction over market share concerns. New York State blocked the deal in February, stating the combination would have nearly

"Competitive title insurance and title information markets are essential to providing Americans affordable and high-quality title insurance products," Bruce Hoffman, the FTC's bureau of competition director, said in a press release. "The merger threatens to continue a trend of consolidation in these markets. Our action seeks to preserve important and beneficial competition that plays out every day in every real estate transaction across the United States."

The

The Consumer Federation of America applauded the FTC's action.

"The title insurance market is a noncompetitive market even without the proposed merger," J. Robert Hunter, the CFA's director of insurance, said in a press release. "Beyond the concentration problem, the title insurance market is plagued by 'reverse competition,' where the ultimate consumer, the homeowner, has essentially no say in which insurer writes the business, and insurer marketing efforts focus on distributing kickbacks to real estate professionals, which drive up prices. The FTC action to stop the merger, coupled with similar action in New York, should seal the fate of this proposed merger and protect consumers from the problems it would have caused."

The FTC said the deal would eliminate significant competition in 45 states and the District of Columbia. In many states, the combined market share for large commercial transactions is greater than 50%; in most states, the combined market share is greater than 40%, the agency claimed.

"Among the Big 4, Stewart has shown a willingness to undercut the other underwriters, and has developed a reputation for finding creative and customer-friendly ways to defer costs. Absent competition from an independent Stewart, Fidelity will not need to compete as aggressively on price, coverage, underwriting requirements, or service as it does today," the FTC press release said.

In addition, the deal would eliminate competition among local title plants (which are repositories of real estate transaction record) in six places and give Fidelity a larger ownership stake in another eight where the two companies have joint ownership, the FTC said.

The attorneys general in Arizona, the District of Columbia, Florida, Illinois, Maryland, Massachusetts, New York, Oregon, Pennsylvania, Virginia and Washington were cited by the FTC for their participation in its investigation.

An administrative trial is scheduled to start on Feb. 4, 2020.

"While we are disappointed with this outcome and disagree with the FTC's decision, we are reviewing the lawsuit with FNF in the context of the parties' rights and obligations under our merger agreement. We will communicate our next steps to our stakeholders in the near future as soon as this review is complete," Stewart said in a press release. Other than announcing the complaint, Fidelity did not comment.

The latest extension of the deal's deadline is set to expire on Sept. 18.