If Freddie Mac's credit-risk transfer activities continue to grow, mortgage lenders could eventually see a reduction in the guarantee fees they pay to the government-sponsored enterprise, according to CEO Donald Layton.

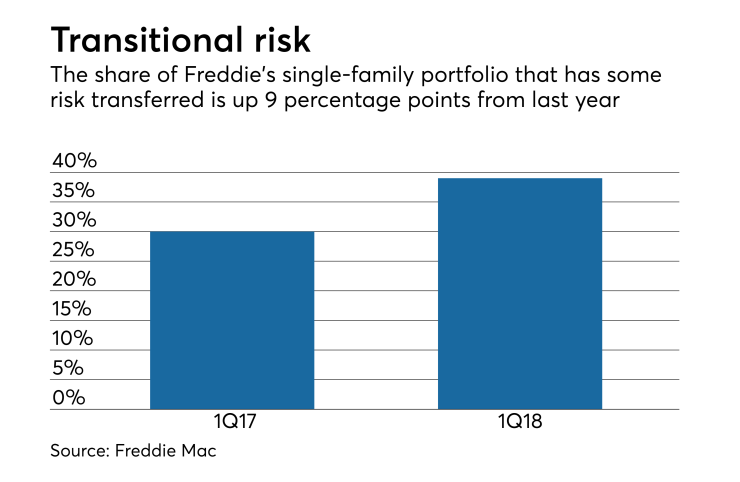

Freddie Mac has transferred a portion of credit risk on nearly 40% of its outstanding single-family book of business to private investors. That's up from 30% a year ago. At that pace, roughly half of Freddie's portfolio could have risk-sharing credit enhancements by this time next year — something that could help lenders in the future.

"In the long run, not yet, but in the long run, if credit risk transfer stays as inexpensive as it is in today's markets, it could possibly lead to the guarantee fees being a bit lower. But that's a long-run issue," Layton said in an interview with National Mortgage News.

While the percentage of credit risk exposure is declining at Freddie due to its risk-sharing deals, its guarantee fee business still largely fuels earnings.

"We are building a fundamentally different guarantor business model for the future. In this more capital-efficient business model, Freddie Mac acts primarily as a conduit for credit risk rather than the traditional, historic buy-and-hold owner," Layton said in the agency's first-quarter earnings call.

However, Freddie will continue to manage underwriting and other credit risk the way a buy and hold owner would, he said in the interview with NMN.

"This does not impact the credit box. Our credit risk, we position [it] as if we were going to hold the credit risk forever ourselves," Layton said in the interview.

Freddie Mac had a serious delinquency rate of 0.97% in the first quarter, up from 0.92% a year earlier, due largely to the natural disasters in the second half of 2017. When hurricane-damaged areas are removed, Freddie's delinquency rate goes down to 0.75%, which is more on par with pre-crisis levels, Layton said during the first-quarter earnings call.

The effect of the recent severe hurricanes on delinquencies is expected to be temporary and is passing through mainland areas in line with historic patterns, but the smaller number of loans Freddie has in Puerto Rico may take longer to recover, the CEO said in the interview.

The GSE is also working on more innovations aimed at making it easier to sell loans to the company. These include increase use of an appraisal alternative that offers immediate representation and warranty relief and the recent introduction of a more targeted 3% down payments program for first-time homebuyers.

Freddie's appraisal alternative is only used in an undisclosed "fraction" of loan sales done through its Loan Product Advisor underwriting system, research suggests in the future, it could represent 10-15% of LPA loan sales, Layton said.

Freddie Mac generated $2.9 billion in net income during the first quarter. That equates to $2.2 billion comprehensive income, the measure used to return dividends to the Treasury. But Freddie won't be making a dividend payment because regulators are letting each GSE set aside a

Freddie's earnings show improvement from

Due to a change to an accounting methodology that adjusts for swings in interest rates back in the first quarter of last year, rate volatility during the first quarter of 2018 had only a "small impact" on Freddie, reducing earnings by $160 million.

Interest rate changes before the accounting change resulted in larger swings that impacted overall earnings results. In the first quarter of 2016, for example, Freddie overall took a $200 million

During the fourth quarter of 2017, Freddie took a one-time write-down of its deferred tax asset in anticipation of this year's tax reform. This quarter, the agency received a $400 million benefit from the reduced corporate tax rate.