Freddie Mac touted its performance supporting the markets during the pandemic and a year of record originations in its earnings call, announcing also that it nearly doubled its net worth thanks to the new capital requirements from the FHFA.

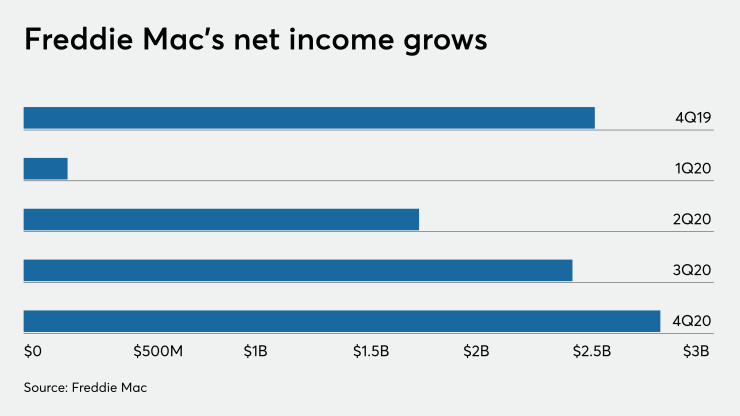

The government-sponsored enterprise reported fourth quarter net income of $2.9 billion, compared with $2.5 billion

For the full year of 2020, Freddie Mac earned $7.3 billion, slightly higher than the $7.2 billion

"We delivered record liquidity of $1.2 trillion at a critical time, helping 4.6 million families purchase, refinance or rent a home, a significant increase compared to the 2.6 million in 2016," Chief Financial Officer Chris Lown said in his introductory remarks during the call. "First-time home buyers represented 46% of the 1.1 million homebuyers we supported and of the over 800,000 multiple family units we helped finance, 96% were affordable to families making at or below 120% of the area median income."

This was the company's first results call following former CEO

It was also the first call since the Jan. 14 agreement between Freddie Mac's regulator, the Federal Housing Finance Agency, and the Treasury, which allows it and Fannie Mae

Because Freddie Mac's requirement to pay dividends on the senior preferred stock held by the Treasury has been put on hold so it can build capital, the company's net worth grew to $16.4 billion as of Dec. 31, 2020, from $9.1 billion on the same day in 2019.

But the retained earnings also increased

Freddie Mac's single-family business did $1.1 trillion of activity during 2020, up 141% from the prior year, a result of the higher refinance and purchase activity resulting from the low mortgage interest rate environment.

This segment earned $4.5 billion in 2020, up from $4.3 billion in 2019. For the fourth quarter, the single-family business earned $1.9 billion, compared with $1.3 billion in the third quarter and $1.4 billion in the fourth quarter of 2019.

More than 700,000 single family Freddie Mac borrowers had entered into forbearance agreements with its servicers during the pandemic and nearly 61% or 437,000 had exited as of Dec. 31, Lown said.

Meanwhile, the multifamily segment had 2020 earnings of $3.1 billion, up from $1.8 billion in 2019, because of higher guarantee fee income driven by portfolio growth and lower fair value losses on guarantee assets due to lower interest rates.

In the fourth quarter, this segment earned $1.15 billion, compared with $1.18 billion in the third quarter and $502 million in the fourth quarter of 2019.

Freddie Mac did $83 billion of new multifamily business in 2020, up from $78 billion the previous year.

But the negative effects of the pandemic were seen in Freddie Mac's capital markets segment results. This business lost $137 million in the fourth quarter and $324 million for all of 2020 on a net basis.

On a comprehensive basis, which includes changes related to available-for-sale securities and changes related to cash flow hedge relationships, Freddie Mac had a net loss in the capital markets segment of $502 million for the fourth quarter. That loss wiped out gains earlier in the year, so the segment lost $204 million in 2020.

The year-over-year loss was attributed to lower net interest income, driven by an increase in amortization expense due to higher loan prepayments. That was coupled with additional expenses as a result of payments that needed to be made to security holders at the full monthly coupon rate when mortgages pay off in the middle of a month.

While Freddie Mac's custodial trust account balance increased due to the higher prepayments, it earned a minimal yield due to the low interest rate environment.

However, as a result of the FHFA requiring Freddie Mac to keep loans with COVID-19-related forbearance in mortgage-backed security pools for at least the duration of the plan, "the company's less liquid assets are likely to increase in future periods as it will likely purchase a higher amount of delinquent and modified loans from securities after borrowers exit forbearance plans," the earnings release said.