Freddie Mac reduced its 2019 origination projection in its latest monthly forecast, but strong coinciding housing numbers could suggest a future upward revision.

Single-family mortgage production could total more than $1.67 trillion this year, according to Freddie's March forecast. That estimate is down from last month's prediction of nearly $1.69 trillion.

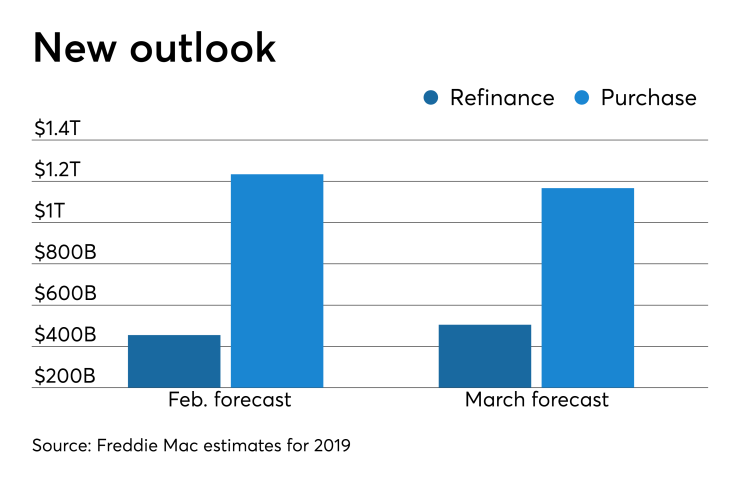

The government-sponsored enterprise estimated that the average 30-year mortgage rate would be 4.5% in 2019, or 0.1% lower than previously projected; and that the refinance share of the market will be 3% higher at 30%. The full-year estimate for refinance volume was $50 billion higher at almost $505 billion.

But the projection for purchase volume was revised downward by almost $70 billion to almost $1.17 trillion. Also, Freddie lowered its forecast for the growth rate of the gross domestic product by 0.5% to 2% due to factors that include declines in residential fixed investment and consumer spending. Its home price growth forecast was lowered by 0.6% to 3.5%.

However, Freddie may have drawn up its estimates before the release of the latest report on existing home sales, which registered

"Existing-home sales bounced back in February after a sluggish start to the year," Joel Kan, associate vice president of economic and industry forecasting at the Mortgage Bankers Association, said in a press release. "The 5.5 million sales pace last month was the strongest since March of last year, and is a sign that some buyers were able to shrug off some of the market uncertainty in late 2018 and early 2019. Although home sales were still below where they were a year ago, we are optimistic that there will be more growth in purchase activity in the coming months."