Freddie Mac fulfilled

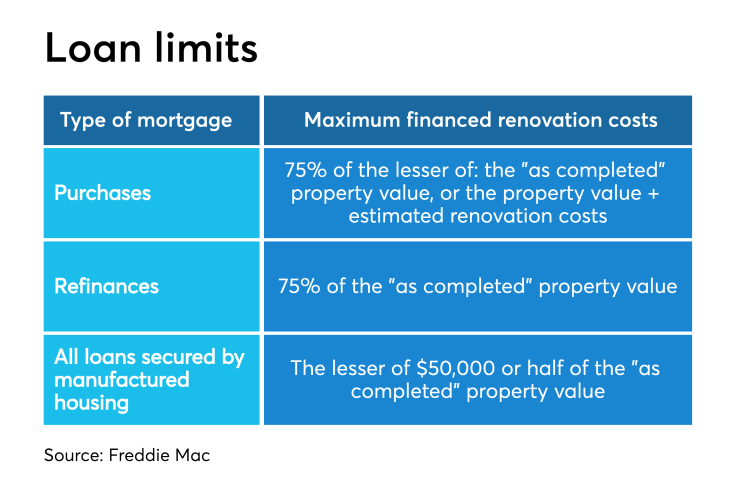

Freddie added underwriting requirements for the loan to its guide on Wednesday. These include restrictions on the amount that can be financed. For purchase loans, the maximum financed renovation costs are 75% of the lesser of two measures: the "as completed" property value or the property value plus estimated renovation costs. For refinances, the maximum financed renovation costs are 75% of the "as completed" property value.

"The CHOICERenovation solution gives borrowers the opportunity to make improvements, renovations and upgrades to a home using a purchase or no cash-out refinance loan that will be eligible for sale to Freddie Mac," Danny Gardner, senior vice president at Freddie Mac, said in a press release.

Lenders will need to obtain approvals and agree to be subject to recourse in order to offer any single-close financing for repairs completed after closing, according to the release. Sellers may request the removal of recourse once repairs are complete, according to Freddie Mac's guidelines.

Single-close renovation and purchase loans underwritten in line with Freddie Mac's guidelines also can alternatively be held in portfolio and then sold to the government-sponsored enterprise on a nonrecourse basis once repairs are completed.

The loan can be used for purposes that include repairs to damage from natural disasters, and remodeling projects aimed to preventing future damage from events like hurricanes and storm surges.

Eligible properties include one-to-four unit primary residences, second homes, one-unit investment properties and certain condominium, planned unit development, cooperative and manufactured home dwellings.

The maximum financed renovation costs for all loans secured by manufactured homes are the lesser of $50,000 or half the "as completed" property value.

Appraisal reports must be based on an interior and exterior inspection and include an "as completed" value subject to the completion of renovations. Renovations must be completed within 365 days of the note date.

Sellers need to establish a custodial account for repairs completed after closing and deposit proceeds that will cover the cost of the renovations plus a 10% contingency reserve to cover contingencies. Any remaining funds after renovation must be used to reduce the loan's unpaid principal balance or eligible additional renovations. In refinance transactions, proceeds can be disbursed to the borrower, but the total must be in line with Freddie Mac's guidelines for no cash-out refis.