Freddie Mac is delaying updates to the

Lenders were originally going to have the option to begin delivering the updated ULDD file on Feb. 26. Now, they can begin using the new format on March 5. Phase 3 includes 30 new data points and updates to existing data points, primarily to incorporate new Home Mortgage Disclosure Act reporting requirements and changes related to condominium loan reporting. Fannie Mae began allowing optional delivery of its Phase 3 ULDD files late last year.

Even after the soft launch next week, Fannie and Freddie won't require lenders to use the new standards until loans with application dates on or after Jan. 1, 2019 and delivery dates on and after May 20, 2019.

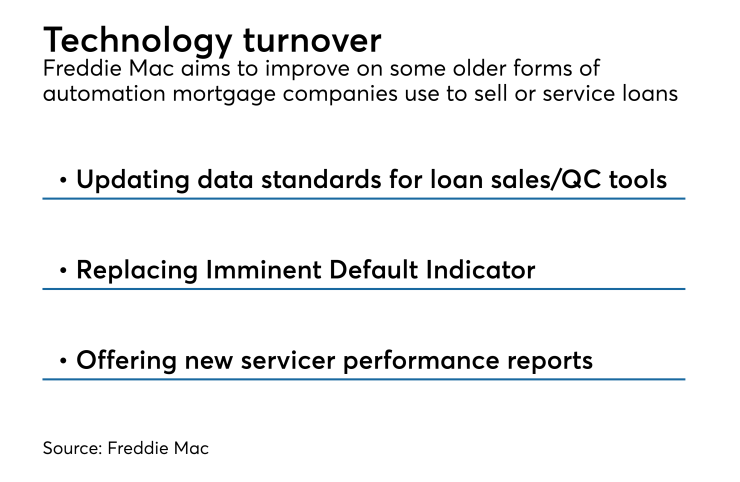

Freddie recently rebranded its selling system as Loan Selling Advisor. It has been integrating the technology with Loan Quality Advisor and other parts of the agency's Loan Advisor Suite. The suite handles quality control functions linked to loan sales.

The agency designed the integration to allow lenders to access the selling system through a single LAS portal sign-on. There were

While the ULDD rollout is facing a delay, Freddie Mac's new Workout Prospector servicing tool and related reporting requirements are up and running this week as planned, according to a separate bulletin.

Freddie is planning to retire its Imminent Default Indicator technology used by mortgage servicers and replace it with new automation called Workout Prospector starting July 1. The agency is encouraging lenders to start using the new technology, which accommodates a new type of modification Freddie and Fannie Mae recently introduced, as soon as possible.

In addition to planning to retire and replace its Imminent Default Indicator, Freddie has retired and replaced some automated reporting tools servicers use to examine their performance.