A data validation integration Freddie Mac is adding to its technology platform this summer could also deliver representation and warranty relief to lenders when it verifies self-employed borrowers' incomes.

So far the only company Freddie has approved for this type of data validation is LoanBeam, a fintech vendor that uses optical character recognition to extract borrower tax transcript data. Freddie Mac plans to integrate LoanBeam's technology into the Loan Product Advisor underwriting system this summer in order to more quickly validate data.

Vendors validating self-employed borrowers' incomes for Freddie must have "a high success rate in OCR" that gives Freddie confidence in the integrity of extracted data, said Sam Oliver, a vice president at Freddie Mac who works with the agency's

Based on data from millions of scanned documents, LoanBeam has a 99.7% accuracy rate, according to the government-sponsored enterprise.

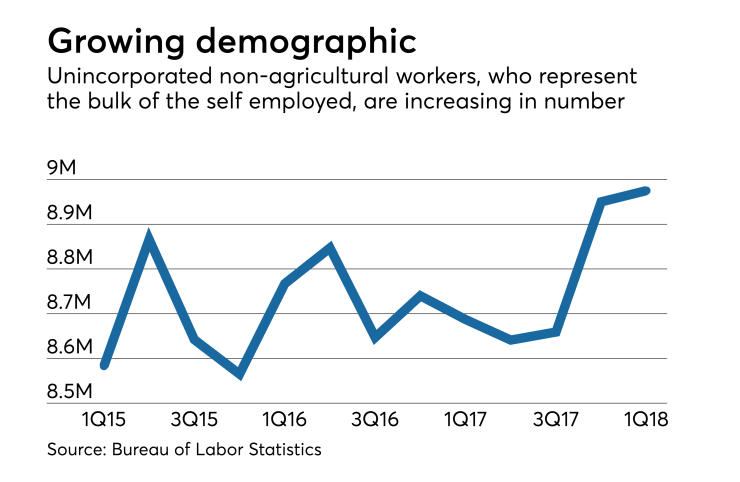

The self-employed are roughly 10% of the workforce and the seasonally adjusted, quarterly average for the group that represents the majority of the self-employed (unincorporated workers in nonagricultural industries) is higher than it's been in at least three years, according to the Bureau of Labor Statistics.

Other estimates for the percentage of self-employed workers are at least triple that, according to Freddie Mac. When employees of self-employed workers are counted, the number rises to 30%, according to a Pew Research Center study.

"In the current competitive purchase market, lenders who better serve the expanding self-employed borrower market will have a competitive advantage and be able to grow their businesses," said Dave Lowman, executive vice president at Freddie Mac, in a press release.