WASHINGTON — Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

The $5.4 billion write-down was greater than the $3 billion capital cushion that regulators let each government-sponsored enterprises set aside at the end of 2017. Fannie Mae had a $6.7 billion write-down that resulted in a $6.5 billion fourth-quarter loss and a

"Excluding this significant item, comprehensive income was $2.1 billion," Freddie Mac Chief Executive Donald Layton said during a conference call Thursday.

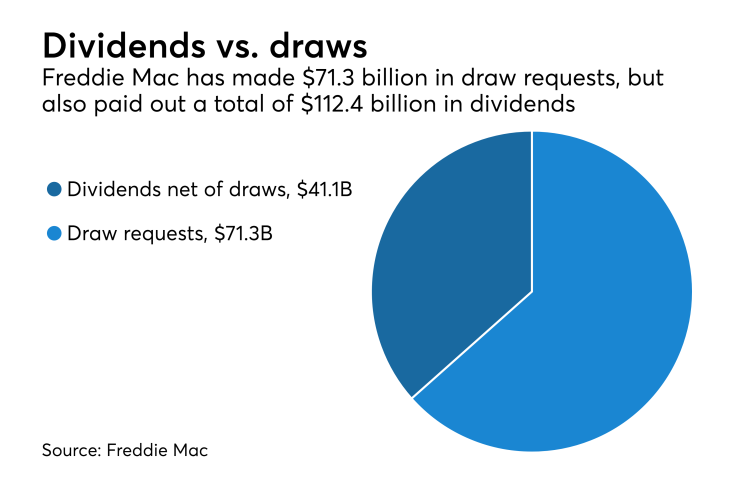

Freddie's available funding under an agreement with the U.S. Treasury is $140.2 billion. Since the Treasury funding agreement was established nine years ago, "Freddie Mac has returned 60% more than we have received from Treasury in draws," Layton said.

Meanwhile, Freddie Mac is growing it single-family business and funded $344 billion in single-family mortgages in 2017. More than one-third of financing was provided to small and midsize lenders via the agency's cash window.

"This is no accident. It is the result of our increased competitiveness and our work to revamp the mortgage experience with lenders we serve with better technology to lower their costs and enable them to provide a better experience to their home buying customers," Layton said.

Layton also noted that Freddie Mac's purchases of mortgages for first time home buyers is at a 10-year high. And Freddie Mac met all of its affordable housing goals for 2016, as mandated by the Federal Housing Finance Agency, he said. The FHFA has penalized Freddie for missing its affordable housing goals in the past.

Overall, Freddie Mac reported net income of $5.6 billion for the full year, compared with $7.8 billion in 2016. In 2017, Freddie Mac benefited from its multifamily business with record purchase volume of $73 billion, up 29% from the prior year.

"Freddie Mac was the nation's top multifamily financer for the third straight year," Layton said during the call. And during the past five quarters, multifamily originations have been more profitable half of the time than single-family originations.

However, the single-family business is more profitable when combined with Freddie's capital market business, "which is highly profitable," Layton said in an interview.