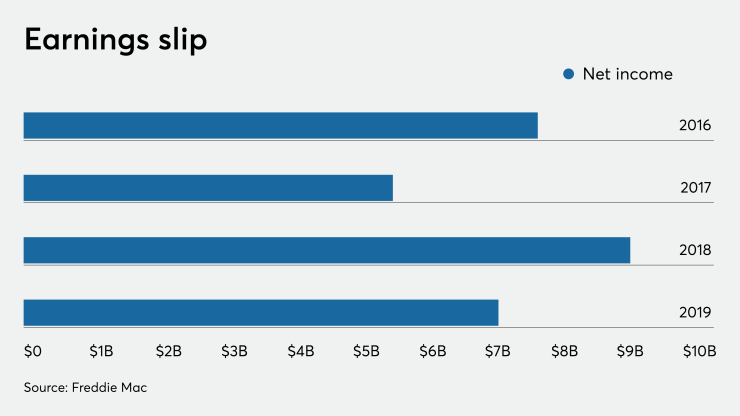

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, according to CEO David Brickman.

The government-sponsored enterprise brought in $7.2 billion in net profit for 2019, down from $9.2 billion

"We saw

The GSE's return on conservatorship capital — its proxy for return on equity — was 15% for the year, nearly identical to 2018's 15.2%. Freddie also reduced the amount of conservatorship capital needed to support its business by $4.8 billion. Credit risk transfer activity, home price appreciation, the disposition of legacy assets and a decrease in deferred tax assets were the major contributors to the decrease, according to Brickman.

Freddie Mac's net worth increased to $9.1 billion at the end of the fourth quarter from $4.5 billion a year earlier due to the company's

While still executing its mission of providing liquidity, stability and affordability to the housing market, 2019 also represented an evolutionary year for the GSE.

That evolution "includes a successful launch of the uniformed mortgage-backed security, our continually evolving credit risk transfer programs, and advancements in our internally and externally focused technology," said Brickman. "Launched in June, the UMBS is one of the most important developments in housing finance since our founding. In a short time, we have seen more than $27 trillion in securities traded in the to-be-announced market."