The small-balance commercial mortgage market is so fragmented that one name from the past sees a chance to re-enter the space.

Bayview Loan Servicing, which

The origination unit will be operating as Silver Hill Funding, a slight variation on the Silver Hill Financial name it used in the past.

Many of the lenders on small retail, multifamily or other commercial properties tend to be local, and more and more of them have entered or returned to the market of late as the economy has improved. But few are making such loans on a national scale and it's that void Bayview is aiming to fill.

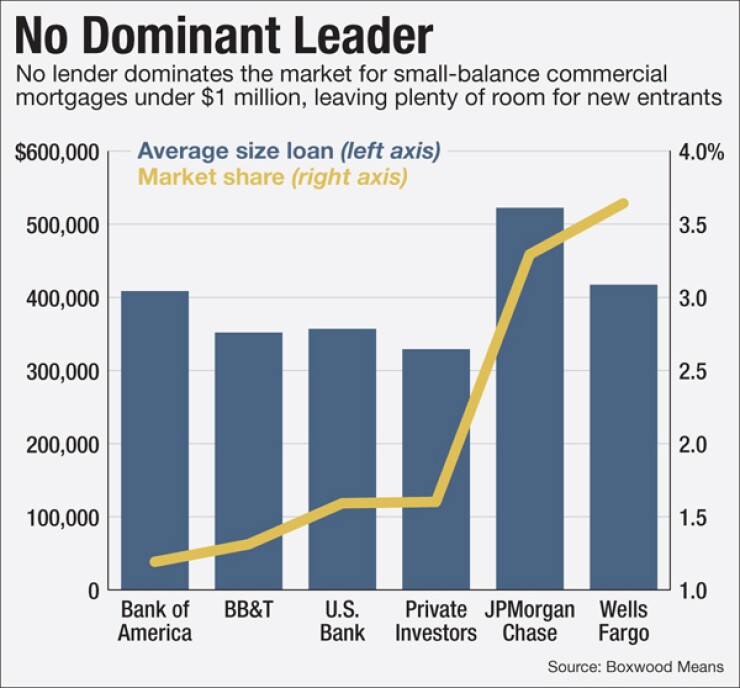

"The time for us to reintroduce the program is ripe. We feel that this segment of the market is underserved. There are only three other national lenders in this space" and the largest does less than 4% of the loans, said Michael Boggiano, senior vice president and national sales manager.

The greatest need — and opportunity — appears to be in the multifamily sector.

Freddie Mac

Boxwood Means, a property valuation and analytics firm that operates the website SmallBalance.com , defines the market as one with properties under 50,000 square feet and $10 million in value.

In 2014, for loan balances under $5 million, the top 15 lenders commanded 21% of the market, and for the segment under $1 million, the top 15 did held a combined share of 18%, said

Even though the largest two originators are Wells Fargo and JPMorgan Chase, small-balance commercial loans tend not to capture the imagination or focus of most lenders," Fuchs said, explaining the fragmentation.

Still, Bob Simpson, vice president in charge of the small loans business at Fannie Mae, said he's seeing more and more players in the space and views the increasing competition as "a good thing."

Fannie buys loans for properties between five and 50 units.

Silver Hill is counting on many of its leads to come from residential mortgage brokers. It will look first for the debt service coverage ratio but if it doesn't qualify then it has the ability to qualify the borrower by giving credit for any additional revenue streams they might have, Boggiano said.

While the credit risk associated with smaller properties is historically not materially different than larger properties, the difference is that when smaller loans go into default, the loss severity is greater on a percentage basis than it is for larger properties, Fuchs said.

"But generally speaking they perform pretty well. That's why you see Freddie coming out with a very promising program for small loans, because they believe in the performance of these loans; if they're underwritten well, they'll perform well."

Silver Hill is not originating loans for either Fannie Mae or Freddie Mac because those agencies are looking for a higher loan amount than its program offers.

Freddie buys loans between $1 million and $5 million and then aggregates them until it has at least $100 million from the originator. Fannie Mae turns each loan it purchases into its own commercial mortgage-backed securities, Simpson said, explaining the difference between the two agencies.

The

Cost is one of the reasons why. "What we've focused on is not only the process but getting the transaction costs down. Given the nature of a small balance loan, when your application fees and legal fees and appraisal fees are high as a percentage of the loan amount, it could really make it extremely expensive," Kaufman said.