Healthier economic conditions, more effective underwriting methods and recovering hurricane-impacted states helped drive delinquency and foreclosure rates to their lowest level in over 10 years, according to CoreLogic.

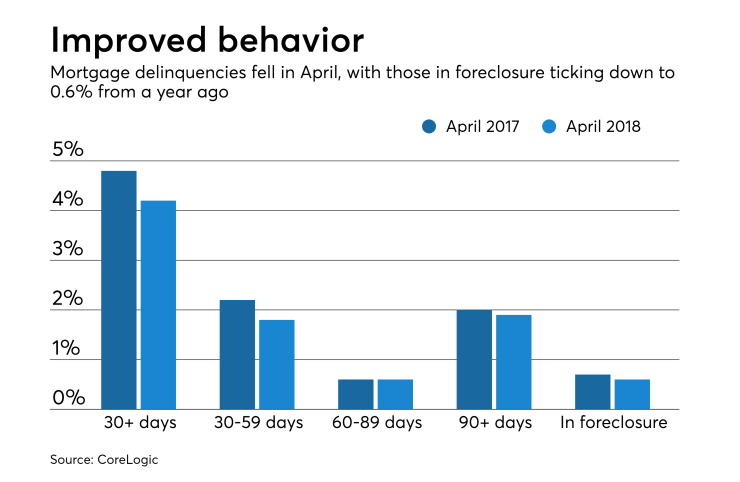

About 4.2% of mortgages were in some stage of delinquency in April, which is down 0.6% from 4.8% year-over-year. The foreclosure inventory rate ticked down one percentage point to 0.6% in April from a year ago and remained unchanged

Job and home price growth, in addition to full documentation underwriting helped push down mortgage defaults, according to Frank Nothaft, CoreLogic's chief economist.

"The latest CoreLogic Home Price Index report revealed the annual national home price growth was 7.1% in May, the fastest annual growth in four years," said Nothaft. "U.S. employers have also continued to employ more individuals, as employment rose by 2.4 million throughout the last 12 months with 213,000 jobs added last month alone."

"Together, this heightened financial stability is pushing delinquency and foreclosure rates to record lows," he continued.

The only two states with significant gains in 90-day delinquency rates were Florida and Texas, which were hit by Hurricanes Irma and Harvey last year.

"Delinquency rates are nearing historic lows, except in areas impacted by extreme weather over the past 18 months, reflecting a long period of strict underwriting practices and improved economic conditions," said Frank Martell, president and CEO of CoreLogic.

"Last year's hurricanes and wildfires continue to affect today's default rates. The percent of loans 90 days or more delinquent or in foreclosure are more than double what they were before last autumn's hurricanes in Houston, Texas, and Naples, Fla. The 90-day-plus delinquent or in-foreclosure rate has also quadrupled in Puerto Rico," Martell added.