Forbearance in October is nearing a 12-month low since exits have soared, but the number of loans in such plans dropped by less of a degree in the past week, according to Black Knight’s latest report.

Around 432,000 homeowners exited their pandemic-related payment suspensions in the first 19 days of the month and more than 280,000 plans have month-end review dates, leaving just 2.3% of loans in forbearance, down from 2.4%

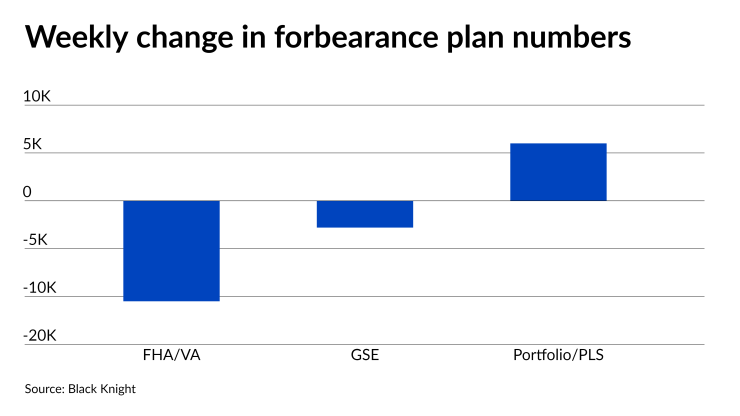

However, in the latest week, numbers were down just 0.6%, contrasting a 10% decline in the previous reporting period.

“After two weeks of sizable drops in the number of active forbearance plans (as hundreds of thousands of homeowners reached the end of their allowable terms), we saw much more modest improvement,” said Andy Walden, vice president of market research at Black Knight, in

The recent decision by federal agencies to

Meanwhile, a separate report by Black Knight shows foreclosure starts returned to the low end of the range seen during the pandemic in September after a jump the previous month. Its numbers contrast earlier ones reported by Attom Data Solutions that show

Black Knight’s numbers show a drop to 3,900 starts in September from 7,100 in

A market-wide rollout of rules around borrower outreach and the need to process high volumes of forbearance exits were among the developments that could have reduced some numbers associated with foreclosure last month. The rules applied earlier for some loans due to