New payment suspensions due to coronavirus hardships

Mortgage servicers have started to take note of this because coronavirus hardship filings have surpassed the 90-day mark that delineates the end of traditional forbearance plans.

While loans granted forbearance under the terms of the federal rescue package can suspend payments for up to six months, extendable once, not all mortgages are eligible for it. Also, the systems may be recording six-month requests as extended.

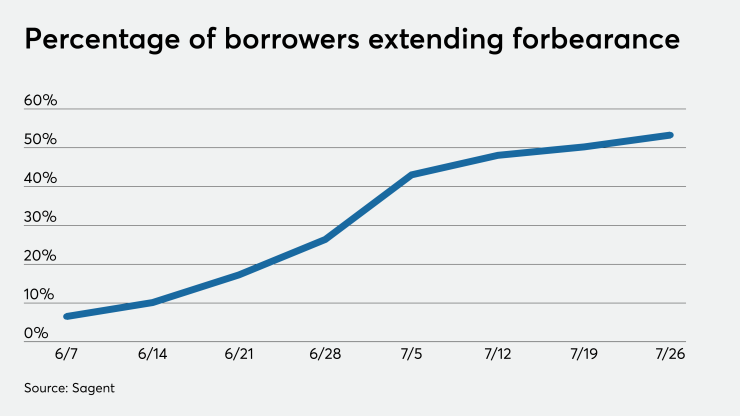

“Forbearances have gone down for seven straight weeks but the extensions during that same period have spiked,” said Dan Sogorka, CEO of servicing technology provider Sagent.

While the number of forbearances fell to 3.8 million from 4.3 million between the week of June 7 and July 26, extensions have risen to 53.28% from 6.52%, according to Sagent’s

The spike in forbearance extensions may reflect in part an end to expanded unemployment benefits, which many believe will be a key test how much damage the coronavirus has done to the economy and consumers’ spending power.

The expiration of expanded unemployment benefits at the end of July could explain why a small percentage of borrowers who had exited forbearance have been asking to re-enter it.

The share of borrowers re-entering forbearance the week of July 26 was 0.67%. The previous week 0.41% re-entered forbearance.

“It’s an interesting wrinkle that we’re going to try to watch going forward,” Sogorka said. “I think that will tell a lot about what’s going on with borrowers and consumers.”