The use of financing to buy fix and flip properties increased 35% annually by dollar volume to its highest level in nearly 12 years, according to

However, gross profits for flippers for post-renovation sales fell to the lowest return on investment percentage in nearly eight years, a sign that this market is becoming less attractive to potential homebuyers. Lower profit margins stand as one of the reasons why more investors seek

"With interest rates dropping and home price increases starting to ease, investors may be getting out while the getting is good, before the market softens further," Todd Teta, chief product officer at Attom, said in a press release. "While the home flipping rate is increasing, gross profits and ROI are starting to weaken and the number of investors that are flipping is down 11% from last year. Therefore, if investors are seeing profit margins drop, they may be acting now and selling before price increases drop even more."

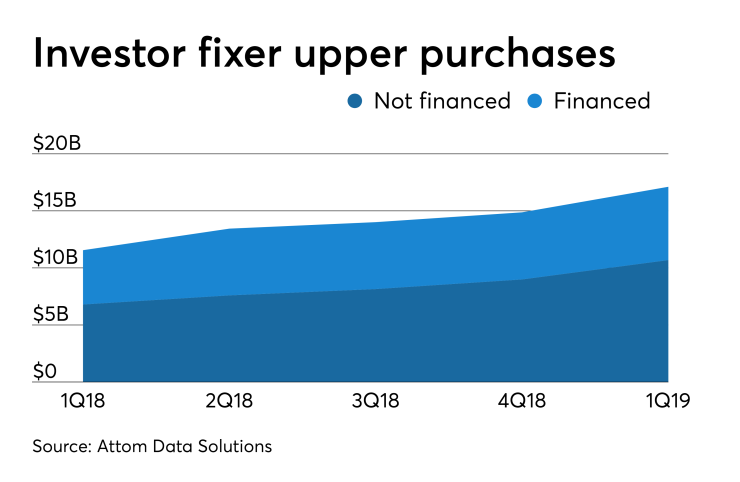

Of the $17.1 billion of

This compared with dollar volume of $5.9 billion during

But one source of these properties might be drying up. Only 11.9% of properties purchased during the quarter by investors were in foreclosure or bank-owned — the lowest since the third quarter of 2014 and the second lowest since the fourth quarter of 2006.

Meanwhile, the average gross flipping profit of $60,000 for the first quarter was down from $62,000 in the previous quarter and $68,000 one year prior, falling to the lowest levels since the first quarter of 2016.

Of the 49,059 properties investors sold during the first quarter, 22.9% went to all-cash buyers, while 14.2% of the purchasers used Federal Housing Administration-insured mortgages. In the fourth quarter last year, 50,093 properties were sold, with 25.1% in all-cash deals and 13.2% to an FHA borrower. For the first quarter of 2018, 53,407 units were sold, 22.1% to a cash buyer and 15.2% to someone receiving FHA financing.

Flipping activity represented 7.2% of home sales in the first quarter, Attom said, compared with 5.9% in the fourth quarter and 6.7% one year prior.