In the coming months, banks, mortgage lenders, consumer advocates and policy wonks will be slicing and dicing the latest Home Mortgage Disclosure Act data, as they do every year. Rarely, if ever, have the stakes been higher.

HMDA data, collected from financial institutions on borrowers who apply for a mortgage, is regularly used by bank examiners in fair lending examinations and enforcement actions. Regulators have stepped up efforts to root out lenders that deliberately fail to provide mortgages in minority neighborhoods, such as a recent

Moreover, the data comes in the midst of a simmering debate about the government's role in the mortgage market as the Federal Housing Administration's finances remain fragile and the government-sponsored enterprises enter their seventh year of conservatorship.

Various stakeholders in the debate are likely to use the HMDA data to back up their positions. While it's early yet, here are five immediate takeaways from the annual data dump that are likely to figure in the discussions.

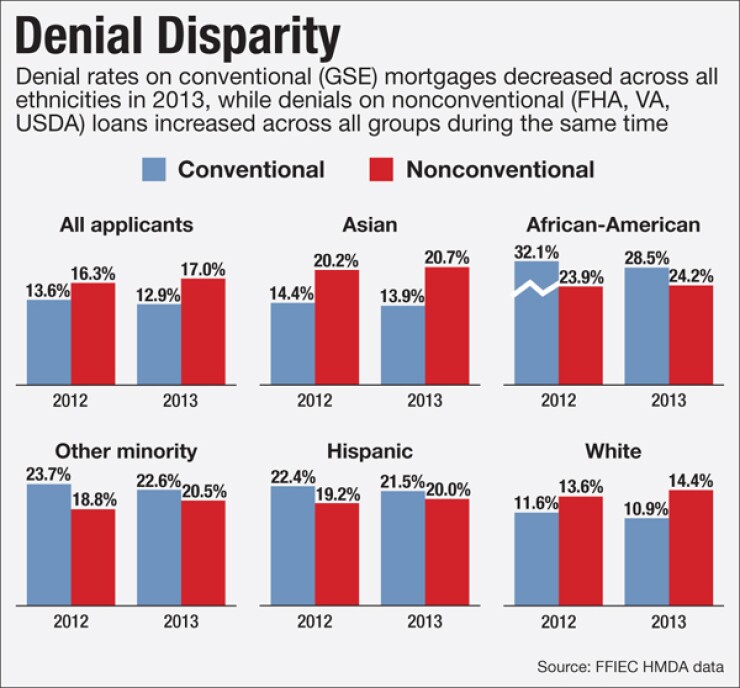

Racial disparities are improving — slightly.

Blacks and Hispanics were turned down for home loans last year at nearly three times the rate of white borrowers, according to the Federal Reserve's

"When the market went over the cliff, blacks and Hispanics went way off the cliff, and while they have come back somewhat, it has been much harder because they dropped down so far," said Maurice Jourdain-Earl, the managing director of ComplianceTech, an Arlington, Va., software firm that specializes in fair lending matters.

Denial rates for conventional home purchase loans backed by Fannie Mae and Freddie Mac in 2013 were 29% for blacks, 22% for Hispanics, 14% for Asians and 11% for whites. In 2012, 32% of blacks, 22% of Hispanics, 14% of Asians, and 12% of whites were denied conventional home loans.

Denial rates typically exclude loan applications that are withdrawn or closed for being incomplete. Partly for this reason, some experts such as David Stevens, the CEO of the Mortgage Bankers Association, claim that the data can appear better than it really is.

The Fed's analysis of the HMDA data excludes manufactured housing and preapprovals, an initial stage in the lending process in which borrowers can eventually be denied.

"We need to look at all the applications that came into the system," said Stevens, a former FHA commissioner. "If a borrower goes in for a preapproval and gets denied, that should be included in the denial rate."

David Skanderson, a vice president at Charles River Associates, said disparities in denial rates usually can be explained by differences in debt-to-income ratios, loan-to-value ratios and other credit factors.

"You often have to dig into loan files to see if there are actual differences in treatment," Skanderson said.

Lending disparity has worsened by income group.

The share of loans extended to low- and moderate- income borrowers also fell. One- to four-family home loans made to borrowers with incomes less than 80% of the median income fell to 26% of the total last year from 31% in 2012, the Fed found.

The HMDA data showed that overall lending to low- and moderate-income borrowers fell dramatically to 28.4% of the total last year from 33.4% in 2012. Loans to Asians and high-income borrowers grew the most last year, at rates of 42% and 50%, respectively, while loans to blacks rose at the slowest pace, 12%.

Bob Davis, an executive vice president at the American Bankers Association, said the HDMA data is a little like employment data, with lower-income prospective borrowers seemingly dropping out of the market.

"Underwriting standards are tighter, and FHA's costs have increased, and the housing crisis has made everyone a little more cautious," Davis said. "The market is weak but it doesn't seem to be dramatically shifting in its structure, other than the decline in the portion of borrowers in the lower income category."

Minorities disproportionately receive government loans.

Blacks, Hispanics and other minorities are disproportionately getting FHA, Department of Veterans Affairs or rural housing loans — traditionally grouped under the rubric of government loans — as opposed to conventional loans guaranteed by the GSEs, Fannie and Freddie.

In 2013, roughly 70% of black borrowers and 63% of Hispanics took out an FHA or VA loan, compared with 35% of whites and 16% of Asians, the Fed report found.

"Blacks and Hispanics are continuing to go to FHA while whites and Asians are migrating to conventional loans," said Skanderson. "That gap has increased but whether it is attributable to steering versus economics is an empirical question."

A problem with this outcome is that FHA loans in particular have become more expensive due to an increase in annual mortgage insurance premiums and a policy change by the FHA that requires the premiums to be paid for the life of the loan. Therefore, minorities are likelier to end up getting some of the most expensive loans, experts said.

Loans backed by the FHA or guaranteed by the Department of Veterans Affairs, the Farm Service Agency or the Rural Housing Service, fell to 38% of the total last year, from 45% in 2012 and from a peak of 54% in 2009. The volume of FHA and VA lending did not decline. Rather, conventional loans backed by Fannie and Freddie expanded.

A lot of FHA loans go to rich people.

A surprise from the HMDA data is that 25% of high-income borrowers got an FHA loan in 2013, which is still up dramatically from precrisis levels of 2007, when just 7.5% of high-income borrowers went the FHA route.

"The government is still subsidizing a lot of high income borrowers," Skanderson said.

There are fewer lenders at a time when the government wants to expand lending.

For the first time ever, the Fed saved data-crunchers a step and provided a list of the top 25 banks and mortgage lenders that dominate the market, originating 42% of all home loans. Wells Fargo topped the list, originated nearly twice the number of loans as its nearest competitor JPMorgan Chase.

The number of HMDA reporting institutions fell by 2% in 2013 with the number of banks reporting falling by 3% and independent and bank-owned mortgage companies falling by 4.2%. But at least one segment of the market is expanding while the rest is contracting: the number of credit unions reporting HMDA data rose 1%, to 2,015 in 2013 from 1,995 in 2012.

Overall, lending fell by 11% in 2013 to 8.7 million loans. Home purchases were a bright spot, rising 13% to a total of 370,000 loans. But the boost could not offset the 23% drop in refinancings of single-family mortgages, the report found.

The HMDA data is comprised of 16.8 million records and is used to run reports on lending patterns by lenders' assessment areas, major cities, counties, Census tracts, and Congressional districts.