As willingness to

Chicago-based Opportunity Financial released SalaryTap, its new loan product in partnership with

SalaryTap then links with a customer’s payroll from their employer and directly withdraws the loan’s biweekly principal and interest costs from there. While other lenders offer similar services, SalaryTap doesn’t charge the borrower origination or hidden fees, relying on the income deduction to eliminate the uncertainty of lending to non-QM customers.

“OppFi's revenue for this product is driven entirely by the interest paid on the loan,” Matthew Gomes, SalaryTap general manager said in a statement to NMN. “Leveraging payroll deduction as the form of repayment reduces the risk premium that would otherwise increase the cost of borrowing for a non-prime consumer.”

This model will grant an estimated 60 million consumers who cannot access traditional mortgage options — with debt-to-income ratios of under 43% — another avenue for borrowing, according to Oppfi CEO Jared Kaplan. SalaryTap only allows borrowers one of these loans at a time.

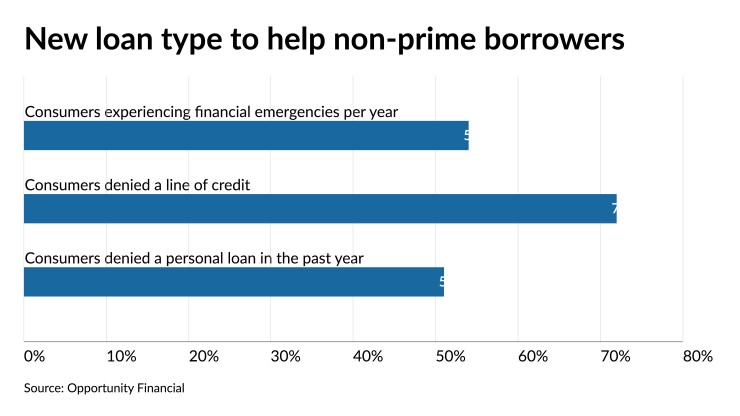

An Oppfi survey from 2019 showed 54% of consumers experienced “financial emergencies” yearly, 72% were denied a line of credit and 51% were denied personal loans.

"We focus on improving outcomes for working families and their employers by reducing financial stress, using a holistic and innovative Financial Care approach and a suite of partners that provide real solutions," Tom Spann, CEO of Brightside, said in a press release.