Finance of America posted a 66% increase in net income from the second quarter to the third, as the company's forward mortgage business set an originations record.

The company, which is in the process of

Along with the record origination volume, Finance of America is posting record margins,

"Our platform was purpose built to create a business that could better withstand the cyclicality of most consumer lending businesses," Cook said. "So, while we continue to take advantage of the favorable rate environment within our forward mortgage segment, we see continued growth in our other lending segments and our non-lending segments.

"These non-mortgage segments will provide the benefits of diversification and powerful tailwinds as the mortgage market shifts," she said. Cook added that she expected the non-lending segments to grow both organically and via acquisitions.

The company funded $9.17 billion in the third quarter, near the midpoint of the estimated range provided when the deal with Replay was announced.

Approximately $8.5 billion came from the forward lending segment. This is up from $7.6 billion in the second quarter. Through Sept. 30, it has originated $20.3 billion in forward mortgages, compared with $11 billion for the same period last year.

Refinancings made up 65% of third quarter volume.

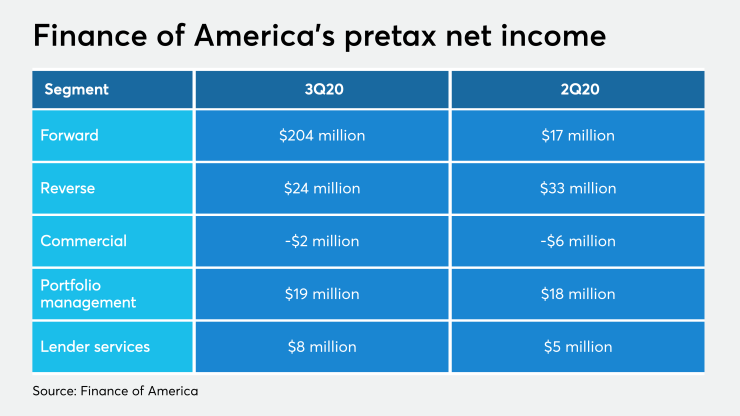

Gain-on-sale margin for the third quarter was 469 basis points, compared with 419 basis points in the second quarter. That helped the unit record pretax net income of $204 million in the third quarter, 74% higher than the second quarter's $117 million.

However, fundings in its reverse mortgage business declined 19% from the second quarter, to $626 million versus $770 million. Pretax net income was down 27% to $24 million from $33 million.

Finance of America is one of the few reverse mortgage lenders that offers

Its commercial lending segment resumed business in June following a pandemic-related shut down.

As a result, year-to-date financings were down 34% to $538 million compared with $835 million in 2019. In the third quarter, Finance of America produced $90 million, and recorded a pretax net loss on the segment of $2 million.

On the non-lending side, Finance of America offers ancillary services and portfolio management.

The ancillary services business includes a student loan fulfilment operation that benefited from seasonal trends during the period. The title agency and underwriting services also saw a boost thanks to the ongoing mortgage boom. As a result, ancillary services as a whole had pretax income of $8 million for the quarter, up from $5 million in the second quarter.

Portfolio management had its assets under management grow by 3% over the second quarter to $16.6 billion, because of an increase in retained reverse mortgages and commercial investor loans. That boosted revenue by 8% to $42 million and pretax net income by 6% to $19 million.