Fidelity National Financial's proposed purchase of Stewart Information Services could solidify FNF's leading market share among title insurers if regulators don't balk at its scope.

Under the agreement between the two companies, FNF would evenly split the $1.2 billion purchase price between cash and common stock and fund it with cash on hand, debt financing and the issuance of common stock to Stewart shareholders.

"We are very familiar with Stewart in the marketplace and see multiple areas where we can assist and accelerate Stewart's growth plans," FNF Chief Executive Raymond Quirk said in a press release. "We also believe there are significant operational efficiencies we can bring to bear by leveraging FNF's shared services infrastructure."

FNF would pay $50 per share in the deal unless the combined company needs to divest assets or businesses with more than $75 million in revenues, up to a cap of $225 million. If divestiture is required, the price could drop on a pro-rata basis, but no further than $45.50 per share.

"We think the market will expect divestitures to be on the high end of that $75 million-$225 million range, which would suggest a market price closer to the floor," equity analysts Bose George, Thomas McJoynt-Griffith and Eric Hagen of Keefe, Bruyette & Woods said in a report. KBW has business ties to both companies.

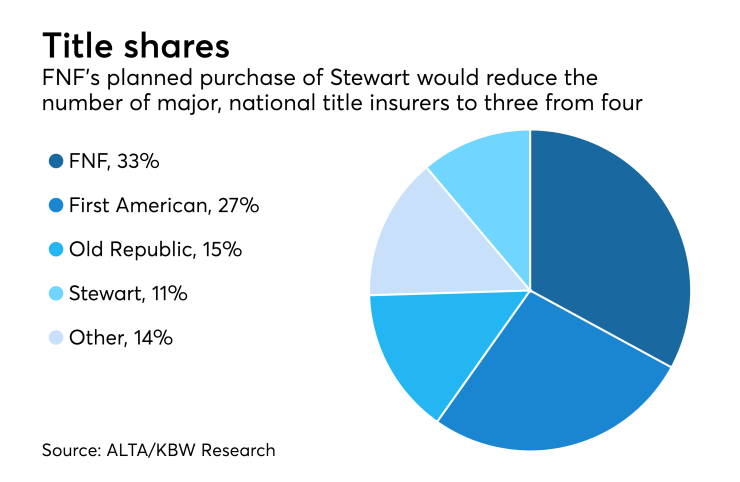

The deal would reduce the number of national title insurance underwriters to three from four.

FNF holds an estimated 33% share of the title insurance market and Stewart holds an 11% share, based on an analysis of 2016 total premiums written by KBW and the American Land Title Association. Shares of both companies started the day higher in response to the proposed acquisition.

"We see tremendous potential in working with the Stewart management team to invest in and grow the Stewart brand on a national basis as part of our long-time, successful strategy of operating multiple title insurance brands under the FNF umbrella,"FNF Chairman William P. Foley II said in the press release.

FNF had acquired large underwriters in the past, including

While FNF could consolidate redundancies in back-office operations as part of the deal, "a good part" of Stewart's management is staying on and the company won't close any facilities complementary to FNF, Foley said in a conference call about the deal.

FNF has retention incentives in place as part of the agreement that would be paid out at closing and a year following closing, he said.

If past acquisitions such as FNF's purchases of LandAmerica or Chicago Title are any indication, the Federal Trade Commission could ask the company to divest some holdings where there is concentration at the county level. The FTC historically has looked at "control of data information" at that level, Foley said.

Stewart shareholders would have the option to receive the consideration in all cash or all stock, subject to certain conditions. They could see pro rata reductions in line with the extent either the cash or stock component is oversubscribed.

The stock component of the deal is subject to a fixed exchange ratio based on FNF's weighted average price for 20 trading days prior to the acquisition agreement. For Stewart stockholders that elect to receive their consideration entirely in FNF common stock, that ratio is 1.285.

The deal will need approvals from Stewart stockholders, and federal and state regulators to proceed.

Lower mortgage origination volumes are putting