Another adjustable-rate mortgage index is going away as the Federal Home Loan Bank of San Francisco will no longer publish the monthly Eleventh District Cost of Funds Index after January 2020.

Unlike Libor, which is

Today there are only nine financial institutions that are COFI reporting members.

When the COFI was originally developed in 1981, there were over 200 savings institutions that reported their cost of funds data to the FHLB-SF for inclusion in its calculation.

The last monthly index, which will cover December 2018, will be published on Jan. 31, 2020.

The FHLB-SF has given the UCLA Anderson Forecast, a unit of the UCLA Anderson School of Management, a research grant to study existing reference rate indices to use in the absence of the Eleventh District COFI for any outstanding ARMs tied to this index.

The COFI measures how much thrifts in California, Arizona and Nevada paid for the funds they used to originate mortgage loans, such as the interest rate on deposits. The index was used in pay-option adjustable-rate mortgages, among other types of variable-rate loans. It is a weighted average calculation that was designed

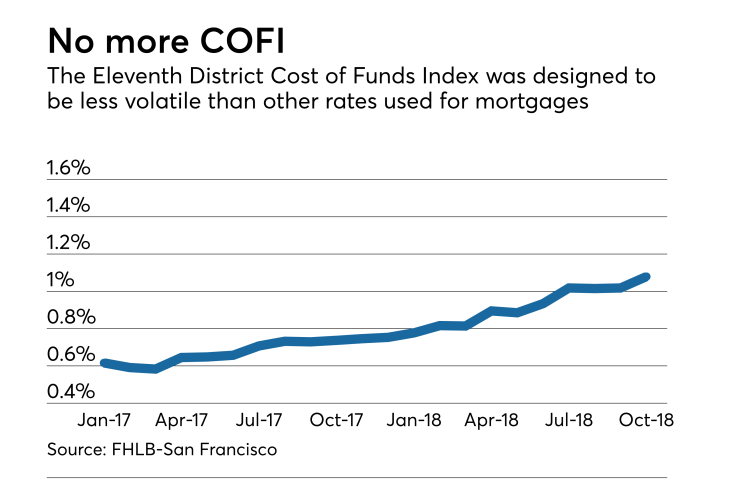

The all-time high for the monthly index was for June 1982, at 12.673%, while its low point was March 2017, at 0.583%.

Since hitting that low, COFI has increased 50 basis points, while the 5/1 ARM increased 100 basis points, according to Freddie Mac.

Besides the monthly COFI, the FHLB-SF calculated semiannual indices for each of the three states. The semiannual index for Nevada was discontinued in 1998 and the one for Arizona was stopped in 2008.

The final California semiannual index will be published on Feb. 18, 2020.