The Federal Housing Finance Agency has revived the idea of putting a question on the loan application asking consumers what language they want to communicate in.

That is part of the agency's request for public information regarding issues that borrowers who do not speak English fluently have during the mortgage process.

It wanted to put a question regarding borrower language preference on the new uniform mortgage loan application it rolled out last year. After the mortgage industry expressed concerns about operational and legal risks, the FHFA in August 2016

The following month, the Department of Housing and Urban Development

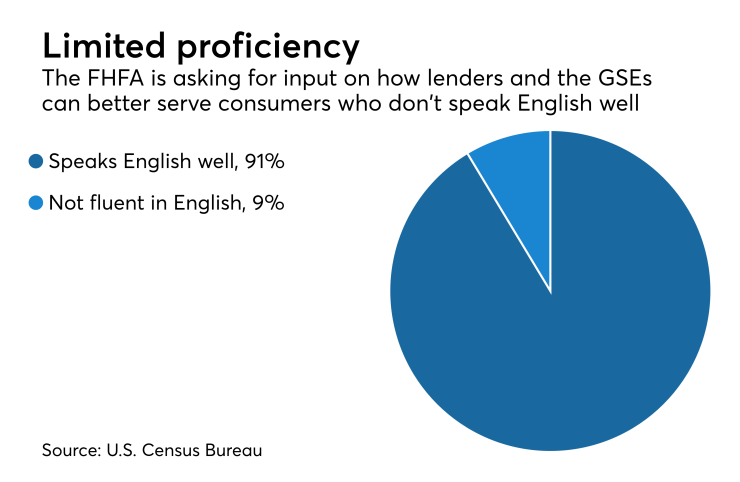

Approximately 25 million U.S. residents — 9% of the total population — do not speak English well according to U.S. Census Bureau data. Spanish is the language spoken by over 16 million of this group.

Even if they are fluent in English, many Spanish speakers prefer receiving literature and information about their loan in that language, said Patty Arvielo, the president of New American Funding, a San Diego-based mortgage banker that works extensively with Hispanic consumers.

In the agency's 2017 scorecard for Fannie Mae and Freddie Mac, the two government-sponsored enterprises are required to identify the major obstacles that consumers with limited English skills have in accessing mortgage credit, analyze potential solutions and develop a multiyear plan.

As part of that process, the FHFA's request for public information seeks answers on existing processes and tools, barriers to accessing mortgage services in other languages, short-term solutions and long-term solutions for working with those with limited English proficiency.

A possible long-term solution suggested by the FHFA in the request involved the inclusion of a question on the loan application where the borrower would be able to choose the language he or she would prefer for communications about their loan.

California law requires consumers to be provided with a written translation of a proposed contract if negotiations for certain types of business transactions, including getting a mortgage, are done in Spanish, Chinese, Tagalog, Vietnamese or Korean.

Large origination and servicing vendors do not provide documents in foreign languages, Arvielo said. Furthermore, the GSEs require that English be used on mortgage documents.

That holds New American back from communicating with borrowers entirely in Spanish.

"There needs to be clarity around the dual language rules, especially when you are a multistate lender likes us," Arvielo said.

But movement towards an industrywide resolution will be slow and expensive. "You have giant entities trying to march on the same path, so we all have to interact together. One little change impacts everybody's business differently, probably less for companies like ours. Our servicing department already is set up with our loss mitigation communications in Spanish," she said.