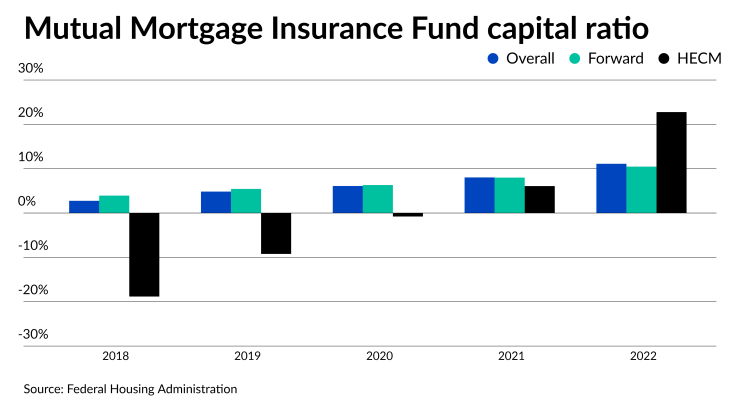

The Federal Housing Administration's Mutual Mortgage Insurance Fund's capital ratio increased 3 percentage points for fiscal year 2022, according to its annual financial status report to Congress.

But during a media call on the report, Federal Housing Commissioner Julia Gordon

The MMIF's capital ratio was 11.11% as of Sept. 30. Its year-over-year increase on a percentage point basis is the largest in the past five years. For

That should give the Fund, used to pay out mortgage insurance claims, the ability for the FHA to play a countercyclical role in supporting housing finance especially if other market participants pull back. Still, given the headwinds in the housing market in the second half of 2022, capital accumulation for the MMIF is expected to decelerate in the near term, the report noted.

The increase in the capital ratio added fuel to the fire for a pair of mortgage industry trade groups advocating for an MIP reduction.

"The Community Home Lenders of America renews its longstanding call for FHA to cut annual premiums and end its Life of Loan policy, in the wake of today's MMIF financial report showing growing reserves and net worth more than 5.5 times its statutory requirement," a statement from the organization said. "CHLA appreciates the technical budget scoring issues raised by cutting premiums — but the doubling of mortgage rates since the start of this year makes these actions more critical than ever."

At more than five times the statutory minimum reserve of 2%, the MMIF is well positioned to withstand an economic downturn, Bob Broeksmit, Mortgage Bankers Association president and CEO, said n a statement.

"Given FHA's healthy financial position, MBA continues to believe that HUD should make FHA loans more affordable by reducing mortgage insurance premiums as soon as budgetary opportunities allow," Broeksmit said. "This move would help offset the impact of higher mortgage rates and improve the purchasing power for many prospective first-time homebuyers, minority buyers and those with low and moderate incomes."

Budgetary considerations are important because the FHA is considered to be "a negative credit subsidy," meaning it returns money to the government, Gordon said.

For forward mortgages alone, the capital ratio was 10.47%, up from 7.99% in 2021. The ratio for its Home Equity Conversion Mortgage was 22.77%, a jump from 6.08% the prior year. Just two years ago, the HECM ratio was underwater at -0.78% and that was a vast recovery from -18.83% in 2018 and -09.22% in 2019.

The improvement in HECM ratio was outsized because of the massive increase in

"Long-term HPA estimates are the primary driver of the HECM portfolio's valuation, which means that even minor shifts in projected HPA can have an outsized impact on the portfolio's future estimated value," Pittman continued. "With the leveling off of HPA and other economic shifts, FHA does not expect the HECM portfolio to sustain the same level of financial performance in the following years."

As of Sept. 30, the FHA had $1.2 billion of insurance-in-force. For comparative purposes, the six active private mortgage insurers had an IIF of approximately $1.5 billion on the same day, according to Keefe, Bruyette & Woods.

A stress test modeling macroeconomic conditions faced in 2007 on its current portfolio would reduce its capital base by 5 percentage points, leaving the FHA with a capital ratio of over 6%, more than triple its congressional mandate, Pittman said.

"It is important to note that the overall performance of the fund can also be represented by its $141.7 billion in capital, a $41.2 billion increase from the prior fiscal year," she noted.

Right now, the agency has fewer seriously delinquent loans in its inventory, as FHA reported a 4.77% rate as of Sept. 30. This is down from a forbearance-driven high of 11.9% in November 2019 and 8.81% at the end of fiscal year 2021, a feat that Gordon attributed to the loss mitigation programs developed as the pandemic started to wind down.

It is working on new tools to help the approximately 350,000 borrowers that remain seriously delinquent, dealing with a "housing market that has changed very significantly in recent months, especially with respect to interest rates," Gordon said. "So the success of all these efforts, I think demonstrates that HUD is very well positioned from a financial perspective to manage whatever economic headwinds are coming our way over the next year or so."

But at the same time, FHA applications and rate locks have trended upward in recent months as mortgage rates increased and the U.S. economy slowed. Data released by Black Knight for October found the

This growth is not a concern as the program is the backstop for the mortgage market, Gordon noted.

"FHA has played this countercyclical role before and one thing that's important about what we do as opposed to almost anyone else out there, we don't manage our program looking for specific market share," Gordon said. "Our goal is to provide access to mortgage credit for people or at times when mortgage credit is not available to people elsewhere."

As credit constricts in other segments, the FHA welcomes those borrowers coming into the program.

"We just don't think about it as a good or bad thing," Gordon continued. "What we think is, this is our mission, and we're here to do our mission."

The strength of the MMIF means that the FHA is well situated to provide access to credit as needed in the current economic cycle, she said.