That may have caused Federal Housing Administration officials to move ahead with a proposal that has long been in the works to streamline

The

Mortgage companies are expecting to have to process more servicing than usual, given that the economy is expected to contract this year, albeit not as much previously anticipated.

Fannie Mae's most recent forecast, for example, suggests gross domestic product will fall by 4.2% in 2020. Previously, the government-sponsored enterprise forecasted a 5.4% decline in GDP.

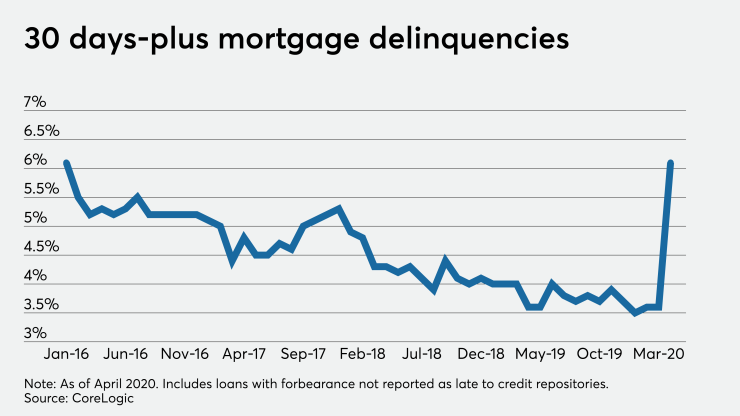

So while low rates have spurred an origination boom that is insulating housing and mortgages companies from a decline in the economy, the coronavirus-related spike in overall delinquencies and forbearance may take some time to reverse. In just one month, that spike erased more than four years of declines in the overall delinquency rate, according to CoreLogic.

Housing advocates have expressed some concern that the industry could make too much haste to process foreclosures in bulk when forbearance periods end, and have warned that such action could lead to procedural mistakes that could be harmful to borrowers.

There are persistent uncertainties about the outlook for delinquencies due to the temporary federal policies both the FHA and government-sponsored enterprises have put in place to address the pandemic.

The FHA said the coronavirus-related contingencies it has put in place for servicing will not be impacted by the streamlining of broader policies.